Yearn Finance merges with the popular market coverage provider Cover and finished a busy week for the decentralized finance protocol as we are reading more in our latest crypto news.

Cronje said that Cover will now become the main coverage provider for Yearn and for DeFi overall. Cover will be able to expand into a new cover money market and will make the CLAIM token collateral and a borrowable asset as well. For the part, Yearn will get coverage for the value and is able to offer the users a reduced risk product. Yearn Finance merges with Cover and the latest collaboration came naturally for both parties according to Cronje.

Yearn & Cover merger https://t.co/32Xv6kOTAF

— Andre Cronje (@AndreCronjeTech) November 28, 2020

Over the past week, Yearn announced a new partnership with Pickle Finance, which is a yield farming protocol, a merger with Cream Finance which is also a lending protocol, and a new partnership with Argent crypto wallet.

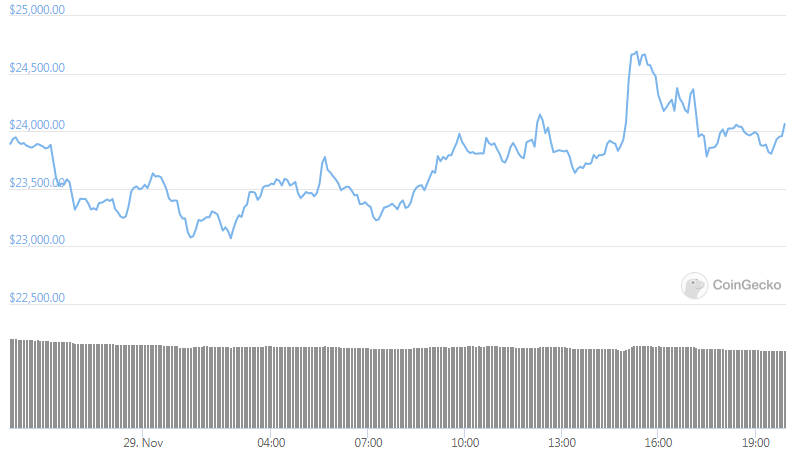

As recently reported on YFI, The YFI/USD exchange rate dropped to 4.34 percent at $22,915 after the 47-day high close to the $25,000. The drop came as a part of the downside correction as it appears that every textbook bull indicator is in the uptrend. YFI later found support close to the $20,000 reflecting on the inclination of the traders to go on with the bull run. The stronger buying demand for YFI surfaced after its parent protocol Yearn.Finance implemented a new improvement proposal as with the YIP 54-upgrade which introduced a so-called Operations Fund to purchase back YFI or other assets with discretion. The traders that the latest upgrade will boost the YFI utility with investor Jason Choi praising the intention of YFI to allocate the token to support security audits, bug bounties, grants, and security as well as pay wages to the Yearn.Finance contributors.

The move lower of the YFI price came in spite of the strength in the rest of the Defi market which was coupled with the strength in Bitcoin’s price and ETH as well. Yearn Finance’s decline came after the founder of the project Andre Cronje disputed rumors that he will be leaving the company. While YFI’s decline from the local highs is far from bullish, the coin could remain in a positive short-term position if it manages to hold above the $15,600 level. one analyst even commented that the price level for the cryptocurrency is critically important as it is holding resistance at two pivotal moments back in August.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post