A Yearn Finance competitor emerged on the market as a new DeFi protocol that pools users’ funds and uses them to achieve high returns. Today in our altcoin news, we are talking about Harvest finance.

The term yield farming was a prominent meme in the crypto space in the past few months as users of Ethereum’s decentralized finance ecosystem used it to describe their search for higher yields. At that time, there was no Defi project that harnessed this meme to its maximum advantage which is where Harvest Finance comes along. In less than two weeks, a group of developers launched the project aiming to make the hard work of using ETH and DeFi much easier. Since the launch, there was a surge in adoption and the project purported $384 million worth of crypto locked in. its token garnered a market capitalization in excess of $10 million.

This might be a strange comment but if $YFI has a competitor, then it might be $FARM.

Several leagues below of course.

But worth looking at.

— Cryptoyieldinfo.YFI (@Cryptoyieldinfo) September 10, 2020

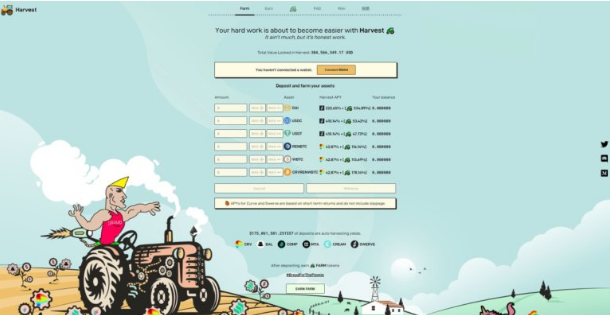

Harvest Finance is a DeFi protocol that pools the user’s funds and them use them to achieve higher returns for low gas costs. The platform now supports stablecoins such as USD coin, DAI, Tether’s USDT with two tokenized bitcoins, and Curve liquidity provider token. The stablecoins now put work into Swerve, which is a Curve fork that is promising to be as decentralized as it is possible as it now has over $600 million of locked value in contracts.

Unlike some other pooled yield farming protocols, Harvest has an extra component of the farm token. FARM is a token that is distributed to providers of liquidity and to FARM crypto trading pairs on DEX which is a coin that is almost always bought back. 30% of the profits made by the farms are used to purchase FARM which means the coin is giving out dividends for the holders.

A decentralized finance commentator said that Harvest Finance can be considered as a yearn finance competitor:

“This might be a strange comment but if $YFI has a competitor, then it might be $FARM. Several leagues below of course. But worth looking at.”

However, Harvest Finance is not a multi-sig setup which means control of the strategies used by the farms and the coin distribution is controlled by the anonymous developers. Harvest can also use the strategy of maximizing yields over security while Yearn.Finance did not switch its stablecoin strategy to ensure users that they won’t lose funds in case of a bug in the Swerve contracts.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post