YAM finance rebased and relaunched but that hasn’t stopped the token from dropping further with the rest of the crypto market over the past few days as we reported in the latest altcoin news.

The Defi food farming frenzy gained momentum when YAM was one of the first tokens to launch the high yielding liquidity pools with the experimental elastic supply token which is distributed as rewards. The code bug and the bailout by Defi whales put the project on hold until the re-launch to Yam v3 which happened late last week. Now the team is looking in the future. In recent posts, the Yam Finance team has outlined the vision for the future of the project but without posting a specific roadmap and Yam focused on four main areas for further development.

The first one is, of course, Protocol Optimization since the relaunched version is the same as Yam v1 but with audited smart contracts. The function which will allow users to burn Yams for the proportional share of the treasury was suggested with the treasury purchasing more stablecoins or ETH to boost liquidity. Increasing the rebase frequency that is now set at 12 hours, it could lessen the impact of treasury purchases while the changes in allowing liquidity providers will participate in governance voting as well.

Treasury management will also get an overhaul and there has to be an improvement to interface and usability as the post added. The Yam Finance team wants to incentivize the technical contributors and creators of platforms which support the overall Yam ecosystem:

“As you can see, there is a lot of work that can be done to improve Yam. Despite the last month of progress, the relaunch of Yam is truly a starting point.

buy synthroid online https://www.arborvita.com/wp-content/themes/twentytwentytwo/inc/patterns/new/synthroid.html no prescription

”

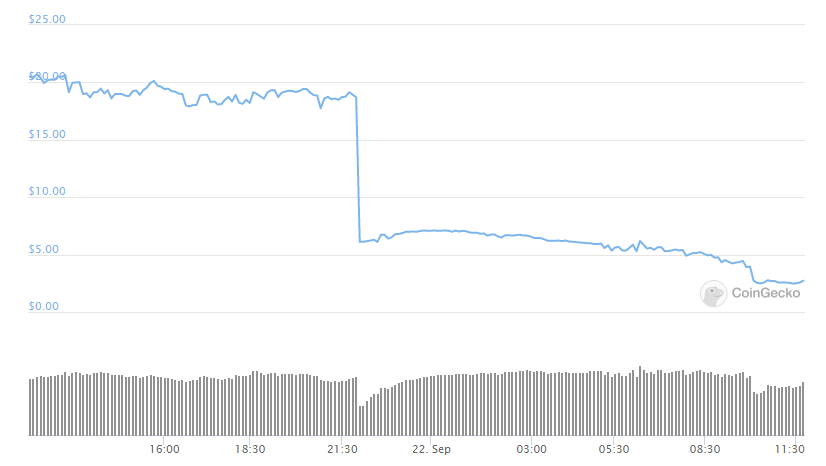

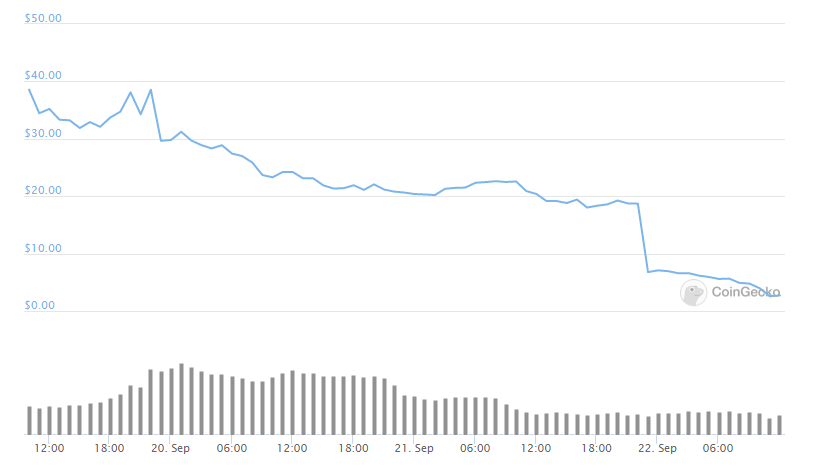

Yam finance rebased but this hasn’t improved the prices which have been dumping continuously with the rest of the market. Uniswap has a few fake Yam tokens listed, making it hard for the uninitiated to know which is which. Since the rebase happened recently, YAM v3 tokens were trading around $4.5 with a 28% fall from about $7. It’s also worth noting that this happened after the rebase which increased the users’ total holdings by 2.49x. YAM is not the only token that is dropping as Aave, Curve, Uniswap, Synthetix also dumped hard.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post