Voyager stocks crash 12% as the crypto company filed for bankruptcy in the US Bankruptcy Court in New York as we can see more today in our latest cryptocurrency news today.

Voyager Digital became the second high-profile crypto company to file for bankruptcy in the past few days and joined Three Arrows Capital in doing so. The New York-based company and its affiliates took the step in the Southern District of New York as per the filing. According to the document, Voyager had 100,000 creditors and between $1 and $10 billion in assets for its liabilities.

Voyagers, today we began a voluntary financial restructuring process to protect assets on the platform, maximize value for all stakeholders, especially customers, and emerge as a stronger company. Voyager will continue operating throughout.https://t.co/TxlO4eua8E

— Stephen Ehrlich (@Ehrls15) July 6, 2022

The Voyager stocks crash 12% overnight and the company revealed that it had $661 million exposure to 3AC as a crypto hedge fund which failed to meet the margin calls for the lenders and filed for bankruptcy. The CEO Stephen Ehrlich said:

“We strongly believe in the future of the industry but the prolonged volatility in the crypto markets, and the default of Three Arrows Capital, require us to take this decisive action.”

Voyager paused trading, withdrawals, and deposits and it is coming up with a new plan for reorganization which will resume account access and will return the value to the customers. Ehrlich said:

“Customers with crypto in their account(s) will receive in exchange a combination of the crypto in their account(s), proceeds from the 3AC recovery, common shares in the newly reorganized Company, and Voyager tokens.”

The Voyager boss added that the company is pursuing all available remedies for recovery from three Arrows capital in the position to confirm that customers with USD deposits in the accounts will receive access to the funds after the reconciliation and fraud prevention process is completed with the Metropolitan Commercial Bank. The financial headwinds came amid the lengthy period of sell-offs on the market which started with the collapse of the stablecoin TerraUSD and the sister crypto LUNA and wiped out tens of billions of investors’ wealth.

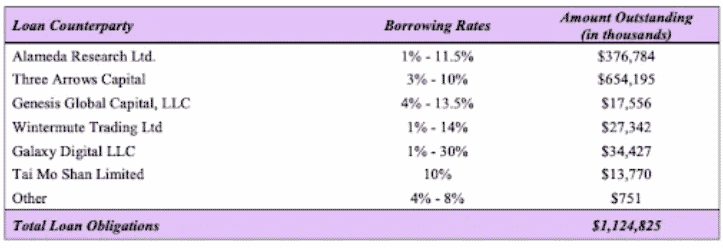

Before the dust from the Terra implosion, the industry faced a huge blow with the lending company Celsius Network halted operations and the withdrawals in June. The Celsius move sent shockwaves on the market and exposed the liqudity crisis faced by other high-profile companies like Voyager, BLockFi, Genesis Trading, Vauld, and Three Arrows Capital. The CEO of FTX Sam Bankman Fried stepped in to provide Voyager with the credit lines via Alameda Research as another company with which he is associated.

Voyager’s filing listed $75 million of unsecured loans from Alameda and made the crypto company as the biggest single creditor. FTX.US is the American division of FTX and is expected to acquire BlockFi after the two companies hit an agreement to increase the size of the revolving line of credit to $400 million from the previous $250 million.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post