Uniswap’s trading volume surged by 450% to $7 billion right after Delta DeFi project launched on the platform as we can see more in our latest cryptocurrency news today.

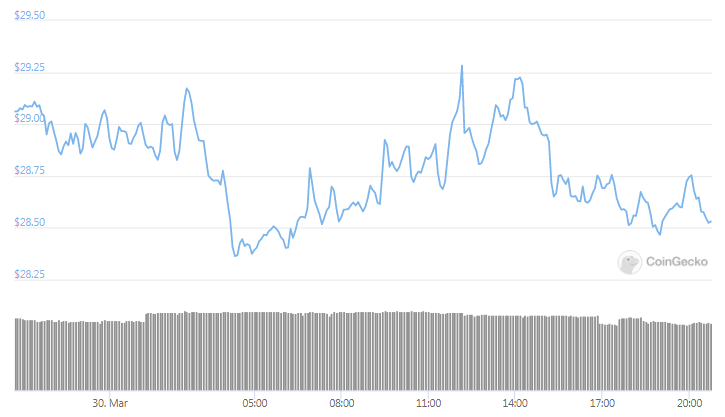

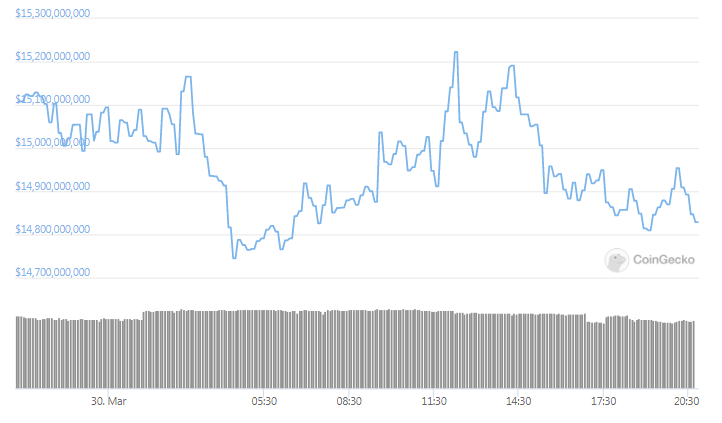

Uniswap’s trading volume surge by 450% over the past 24hours and the total volume according to Uniswap.info is $7.17 billion compared to the $1.6 billion a day ago. The token responsible for most of today’s volume was DELTA as it did $6.13 billion in trading or about 85% of the total volume despite having only $16.4 million in liquidity.

The new record is apparent that it will not stand as Uniswap creator Hayden Adams wrote that the statistics DELTA accumulated won’t count towards the global DEX volume because of a quirk on the DELTA protocol. After these changes, the retail trading volume is set at $1.05 billion which is normal for Uniswap. Delta could not ring a bell because it is new but the token resides on the Ethereum blockchain and launched a day ago. So to get it without staking, you would have to use Uniswap.

Delta calls itself “an on-chain options layer which utilizes a combination of liquidity standards to reduce premiums and offer competitive options prices.” As options trading becomes expensive and volatile with the lack of liquidity, Delta said that it wanted to fix it. The methods for doing it are far from intuitive as all catch-phrases for decentralized financial systems that allow people to trade, earn interest, lend and borrow are using crypto without banks or brokers.

Delta introduces a different schedule for liquidity as the financial team explained:

“When Delta is transferred, a token vesting schedule is activated. 10% of the total token balance is sent to the user while 90% is initially locked and released linearly, over a 2 week period.”

The large volumes that Uniswap sees are the result of the liquidity rebasing system which is an algorithmic way of raising the price to mint new tokens over time. The way that the system is created makes it look like wash trading to boost the volume and the price of the token but it is not because the trading isn’t resulting in the transactions canceling each other out. Instead, Delta uses Uniswap’s liquidity pools to keep the liquidity solid and to make the price less volatile.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post