Uniswap’s Ashleigh Schap who is working as the growth lead at the company, trashed Yearn Finance founder Andre Cronje for complaining about the many forked projects in the DeFi sector, as we can see in today’s altcoin news.

Uniswap’s Ashleigh Schap trashed a recent article from Yearn Finance founder Andre Cronje who criticized that forked protocols in the DeFi space was becoming too many, with Schap describing the recent merger with sushiSwap as validating a “stolen Dapp.” Cronje’s blog post “Building in DeFi sucks” complained about the risk of competitors that are forking his code and combining with other tokenomics in a way to try and drain away users from the products that he has invested plenty of time into building:

“I can build the superior product even, but a competitor can just fork my code, and a token that infinitely mints, and they’ll have twice the users in a week.”

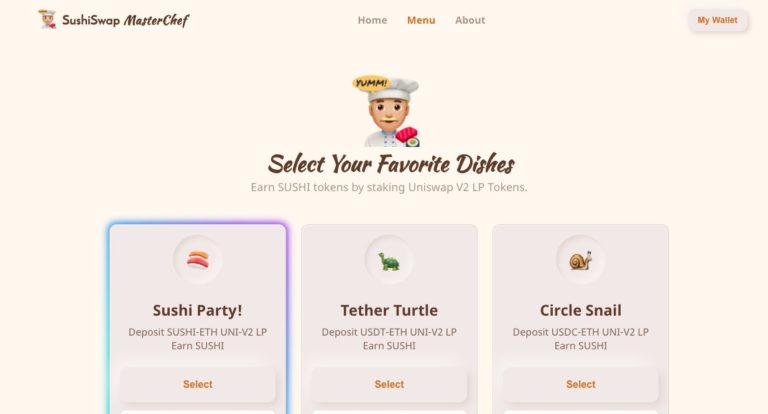

This is what happened when SushiSwap was forked from Uniswap back in August 2020 with the new project launching a native token and yield farming program to leech more than $1 billion worth of liquidity away from the main Uniswap platform. In December 2020, Yearn Finance merged with SushiSwap and it shows the hypocrisy of Cronje’s comments which were not lost on Uniswap’s growth lead who said:

“One of your complaints is that anyone can steal your work in defi. And yet YFI chooses to partner with Sushi. When a legit dapp validates a stolen dapp buy partnering, it just encourages that kind of behavior.”

Schap took aim at Cronje’s comments which described the notion in the community in the crypto sector as “bullshit” and got featured alongside the claim that the “Governance and community kill innovation.” The threat sparked a heated debate among the crypto community with Hasu calling it a “rare look behind the curtain” which reveals the outfit that considers Sushiswap is a stolen dapp which “should be socially shunned.” FTX founder Sam Bankman Fried who was handed control of Sushiswap for a short time in 2020 defended the protocol:

“This is maybe harsh, but I believe it. Uniswap had a long time to do something, anything, with its product. It didn’t. This wasn’t Sushiswap copying brand new code in real time. It was practically public domain.”

Uniswap did reclaim its position as the leading DEX by value but the UNI rewards that ended in November, made Sushiswap reclaim its billion-dollar TVL by offering the yield incentives for the same pairs that Uniswap already incentivized. YFI also announced a merger with Sushiswap in a bid to expand its ecosystem and even absorbed seven prominent DeFi protocols as well including cover Protocol, Akropolis, Pickle Finance, Cream Finance, Deriswap, and Bounce Finance.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post