Uniswap soared 9% at the start of the weekend while Bitcoin stopped at $22K at least for now so let’s read more today in our cryptocurrency news.

Uniswap stands out as the most impressive gainer from the larger cap altcoins while after a day from the multi-week high, BTC was stopped and pushed under $22,000. Similar to the last weekend, this one started with no substantial price movements from the altcoins but Uniswap soared 9% and was among the few exceptions with notable price increases. Last weekend was quite still in terms of the price action and was propelled by the national US holiday, 4th of July. Once that came to an end, BTC started to gain value and increased from $19,000 to $20,000.

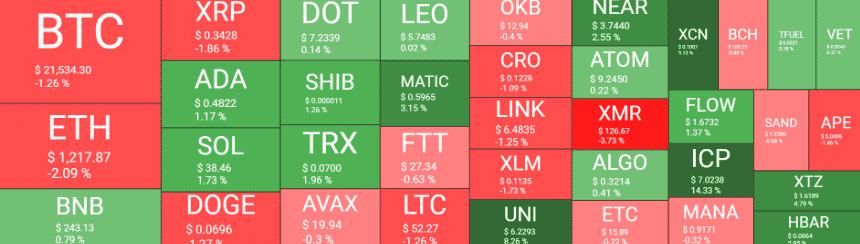

After a few rejections, the asset managed to break above and keep on increasing so as a result, it was soon knocking on the door for $21,000 which was taken down. The crypto continued the increase and surged past $22,000 and tapped a new high at $22,500 but then was stopped at the point and the bears pushed it south by $1000. The market cap stands above $400 billion and the dominance over the altcoins is over 43%. unlike a few other miners, Marathon Digital said it didn’t sell any of the BTC holdings during the market crash. The BTC premium on Coinbase turned green and suggested the investors are back buying.

Most altcoins registered some major gains during the working week but then calmed as the weekend started. Ethereum tapped a multi-weke high of the $1250 level but replaced by over 2% and stands at $1220. DOGE and Ripple are also in the red on a daily scale. In contrast, ADA, SOL, DOT, SHIB, BNB, and TRX are in the green but their gains were quite smaller. From the lower cap coins, XCN, ICP, and UNI Stand out as the biggest gainers, and ICP trades above $7 while UNI reclaimed $6. the cumulative market cap of the assets stands around $950 billion.

In a new lawsuit filed at the start of the month, California residents accused Solana labs of selling unregistered securities and despite repaying the loan to Maker, the Celsius situation continued to get worse with more reports showing that its strategies led to losses for customers and were slapped with fraud lawsuit from the former manager. Blockchain.com also faces a $270 milion loss on the loans that it provided to the struggling hedge fund Three Arrows Capital so due to the team’s inability to provide data about its operations, Elon Musk decided not to purcahse Twitter after all.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post