The Uniswap network fees are still attractive to traders despite the recent UNI price crash due to the turbulence on the market as we saw previously in the altcoin news.

Just before listing on Uniswap, the token’s price dropped to lows of $1.00 after the 400 UNI airdrop recipients cashed out their tokens.

buy temovate generic buy temovate online no prescription

Right after that, bigger buyers stepped in and boosted the price up to highs of $8.50. Since these highs were reached, the price of UNI was sliding lower with it not being able to escape the immense bearishness that was seen over the aggregated Defi ecosystem. If the token was launched in August, there was a strong chance that it would have seen bigger and longer-lasting uptrends. The ongoing bear market intensity only dampened the hype around it and led investors to be more aggressive with taking the profits.

Despite the lack of hype around Defi and Uniswap at the present moment, one investor noted that the Uniswap network fees are still attractive despite the declining UNI price. He noted that with the increasing Bitcoin dominance, investors could gain some good value as they will start hunting opportunities over the next few months. The DeFi sector captivated the attention of the crypto investors over the next few months but the sharp decline in prices and tokens that resided with the fragment of the market struck a serious blow to the hype of what was behind the rise.

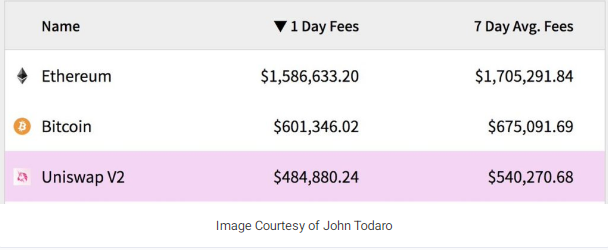

This created a collapsing farming yields session which has compounded the pressure placed on the sector. At the time of writing, UNI’s price was trading under 10 percent of the current price of $2.90 which is around the price where it was trading over the past few days. John Todaro, a crypto-focused venture capitalist explained that Uniswap network fees are highly attractive despite Uni’s price crashing lower:

“Uniswap network fees are still pretty attractive and volumes are still comparable to large centralized exchanges, yet UNI price continues to grind lower. There will be some good value hunting opps in DeFi tokens over the next few months as all eyes turn back to bitcoin.”

If Bitcoin starts recapturing the dominance on the market and goes past $12,000, the DeFi coins could even drop lower which will lead some coins like UNI in oversold territory. Uniswap is now ranked #33 by market cap but is down by 11.11% over the past 24hours.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post