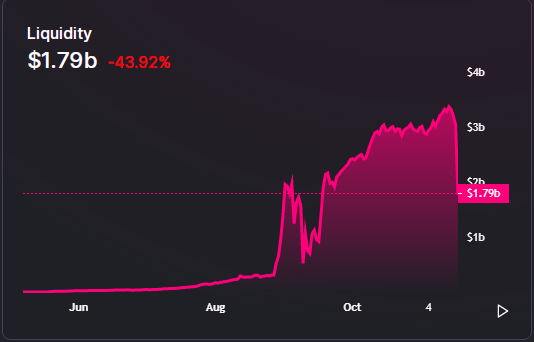

The top decentralized exchange UniSwap lost more than $1 billion in liquidity during the final days of the liquidity mining program. The platform was draining collateral as in less than a day, over $1 billion or 40% of the liquidity left the protocol and pushing Uniswap to the third place in the TVL charts as we are reading more in our crypto news today.

Many analysts warned that this could happen if Uniswap did hold the vote on the future of farming right before the pools expired. These pools are easily drying up and the collateral is going all over the place so from almost $2.5 billion held, they now reached $960 million. According to DeFi pulse, more than 1.3 million ETH worth $600 million, left the protocol while the ETH price is holding steady at the time of writing.

The platform even posted a poll in order to check whether the community wants to receive the token distribution or to go on with the farming. The community proposal to continue UNI rewards at a reduced date is now at the “temperature check” stage.

“Vote in this off-chain snapshot to signal your support for or against! https://t.co/Mr0Uwv1MIg

— Hayden Adams 🦄 (@haydenzadams) November 16, 2020”

However, two whale addresses pledged about 30,000 UNI between them in order to lead the vote into a “yay” phase which means that the liquidity farming will most likely continue. Cooper Turley who actually built the proposal explained:

“The goal of this proposal is to ‘maintain the status quo’, using reduced incentives as a means to continue distribution as we look to optimize allocations in the medium term.”

If the proposal succeeds, there’s a second proposal to extend the farming incentives for about two months but at half the rate of the current distribution:

“Distribute UNI for an additional 2 months from the time this proposal is adopted and executed by governance. Distribute to the same 4 pools, but at half the rate of the genesis distribution.”

As Uniswap lost more than $1 billion, Turley added that the poll will be live for 3 days and If it gets to a minimum of 25,000 UNI in support, they will move the proposal forward to the consensus check phase. This huge movement of crypto collateral only made Maker a favor and it even took the top spot on the market with an 18% dominance. Wrapped BTC comes in second with over $2 billion in TVL while Uniswap dropped to third place.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post