Uniswap loses again since the total value locked or TVL, crashed by 57% to $1.3 billion from the previous .

buy filitra professional online http://www.biop.cz/slimbox/extra/new/filitra-professional.html no prescription

07 billion a few days ago. In our latest crypto news, we are reading more about the analysis.

The rival decentralized exchanges started upping up their liquidity mining rewards in order to attract the former Uniswap liquidity providers which eventually led to SushiSwap tripling its total value locked in one week. Uniswap loses again, on the other hand, having ceased the yield-farming incentive program while Bancor and Sushiswap snapped up the liquidity providers with their targeted rewards. Two days ago, Uniswap’s rewards ended and the cloned AMM SushiSwap announced a new incentive scheme for the four pairings that were initially incentivized by Uniswap.

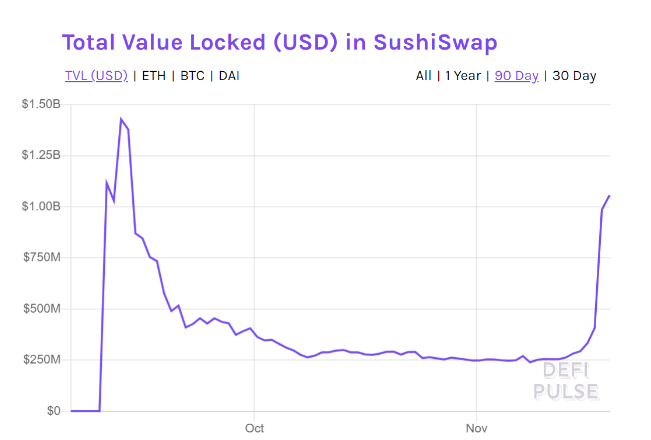

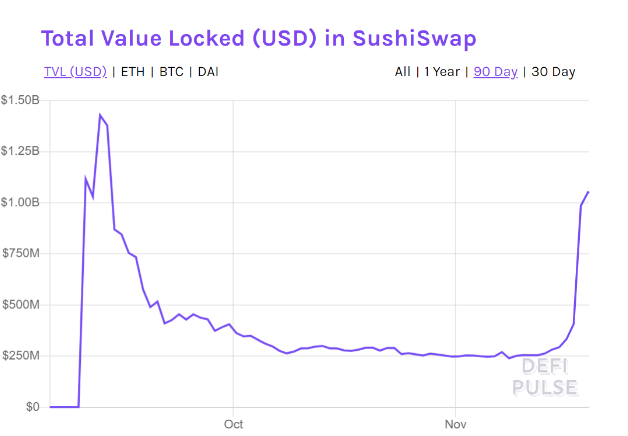

The Uniswap total value locked or TVL crashed by more than $1 billion in less than a day. It posted $3.07 billion a few days ago but now its TVL crashed by 57% to $1.3 billion. By contrast, SushiSwap’s total value locked skyrocketed nearly 160% from $407 million to $1.05 billion marking a 313% increase from a week ago. SushiSwap was not the only Decentralized exchange to launch the “vampire campaign” which targeted Uniswap’s liquidity providers as Bancor also unveiled a liquidity mining program like retroactive rewards a few days ago.

Yesterday, November 18, 1Inch launched the second stage of its yield farming incentives and allocated an additional 1% of the token’s supply to liquidity providers and is CEO and co-founder Sergej Kunz said:

“Right now we’re seeing a lot of other projects launching incentives after Uniswap’s ended. As we are confident that our Mooniswap protocol has a lot of potential to be unlocked while attracting additional liquidity, we decided to announce our new liquidity mining program in order to hunt for the freed up liquidity from the Uniswap.”

AMMs comprise of non-custodial decentralized exchanges that settle trades using Liquidity pool by the users and also to start offering liquidity providers, many DEXs aimed to attract users by offering yield-farming rewards in form of native tokens. UNI’s token blockchain-powered streaming platform, Audius submitted a new governance proposal to reinstate the liquidity’s mining program with about half of the rewards from the previous program. The proposal passed its first round of voting but it has to complete two more stages of voting with about 40 million votes to be implemented. Uniswap however, failed to pass any governance proposal in September.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post