The UNI token price remains stable above the $5.50 level after seeing a massive inflow of investments in the past day. The biggest buy-side order outweighed the relative small sell orders from the users that got the 400 tokens after the airdrop as we reported in the altcoin news previously.

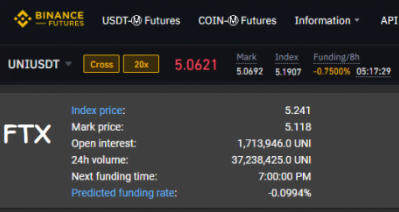

The uptrend was further perpetuated by other exchange listings such as Coinbase listing the UNI token, and binance listing the token within a day of the launch. This also gave the retail investors unprecedented access to the token which seems to be helping to offset the instant sell-side pressure which came as a result of the airdrop. It’s also important to note that the funding for the UNI token is giving bulls more fuel to push it higher with the rates sitting at more than $280,000 per year. The huge negative funding rates are also incentivizing traders to open the long positions on the cryptocurrency. The nature of the short positions will reduce the selling pressure that comes from the people that are trading UNI perpetual swaps.

At the time of writing, the UNI token price is sitting at $5.80 which marks a new all-time high for the cryptocurrency that has been climbing slowly higher over the past few days. it’s also important to know that this marks a huge rise from the $1.00 lows that were set shortly after the listing. The lows came above because of the intensity of the initial selling pressure from the users that sold the tokens that were initially airdropped to them.

After the launch, the token garnered listing on a few exchanges including Binance, Coinbase, and FTX. This led to a huge inflow of buying pressure from investors and helped fuel the upswing. The cryptocurrency is trading around the all-time high as the bears are having a hard time making an impact. another factor that could influence the uptrend of the token is the massive negative funding rates for the perpetual swaps of the token. One trader also spoke about this explaining that about 0.1% of the users are paying each other to short the token which is making a strong bull case for the asset:

“At -0.75% every 8 hours, or -0.0994% every hour, you are being paid 2.2% – 2.4% a day to be long UNI via perps.”

Assuming that this trend will surround the perpetual futures, UNI could rally higher in the upcoming days and weeks.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post