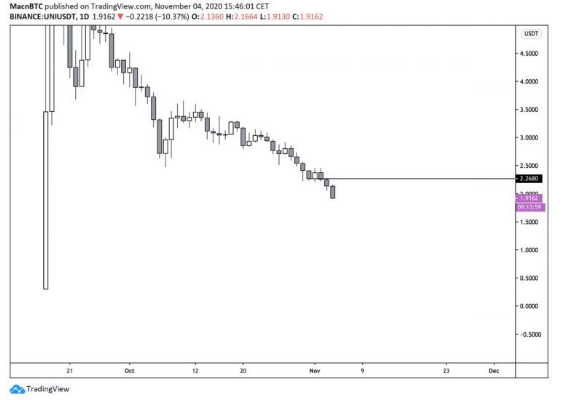

Uniswap’s UNI token liquidation bursts as the altcoin broke the $2.00 region after seeing a huge selloff over the past few months with the post-launch highs of $8.50 marking a macro top which is now over 4 times above the place that it is now trading as we read more in today’s altcoin news.

The recent decline came as some large holders started offloading their UNI with one investor even selling 1.5 million tokens on Binance earlier today. The influx of selling pressure that the Uniswap governance token was facing could be just getting started and it seems that there could be a flurry of $2.00 UNI token liquidation that will put more pressure on the price. One trader pointed to this as a catalyst for more downsides in the near-term.

There are a couple of catalysts that could hold sway over the near-term price action like the imminent launch of Uniswap’s V3 as well as the likely implementation of fee distributions for the UNI holders. Uniswap’s UNI token is now trading over 7% with a current price of $1.99. this marks a slight rebound from the lows set at $1.90 which were set earlier this morning. The rebound from the lows came together with the one of Ethereum surging past $400 as ETH remains the main indicator of the aggregated DeFi sector.

Because UNI didn’t reclaim its $2.00 support level, the bears remained in control of its near-term outlook and could even continue forcing it lower in the upcoming days ahead. One analyst explained that part of the recent weakness will be due to a 1.5 million UNI token sale on Binance. While sharing his opinions on Uniswap token’s ongoing downtrend, one analyst said that the 10x long positions taken at $2.00 will get liquidated at $1.75 making it a potential downside target:

“UNI liquidations about to kick in… x10 longs from $2 getting liqed around 1.75, TPing there.”

did someone just sell 1.5M $UNI tokens on binance over 30 mins lol

is this capitulation? 🤔

— No Context Non-Stop Hentai (@DegenSpartan) November 4, 2020

The upcoming few days could provide some insight into the fate of the UNI token. Further downside here could spark a liquidation cascade of the long positions and could drive it lower. As reported previously, Uniswap’s proposal to airdrop UNI tokens to users of proxy applications like Dharma and Opyn failed. The voting ended on October 31 at 4:00 hours EST. The Uniswap vote ended in defeat for the second airdrop of Uni tokens. less than 4% of UNI token holders voted but failed to establish a quorum. The platform introduced the UNI governance token and airdropped $150 million tokens to the past Uniswap users.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post