Uniswap’s UNI token drops as the investors fear regulatory crackdown but it is not the only cryptocurrency that plunged lower as the market gets swamped by uncertainty so let’s find out more in our cryptonews today.

The recent news about the CFTC’s decision to launch criminal charges against the BitMEX creators contributed to the entire market getting weaker which sparked some concerns among investors for their governance tokens in the decentralized trading platforms. One trader explained that it is naïve to believe that the regulators will not come after the decentralized platforms like Uniswap so they could be taking some money off the table until a regulatory crackdown is to happen on the decentralized products and platforms. This could also add more selling pressure for Uniswap’s token.

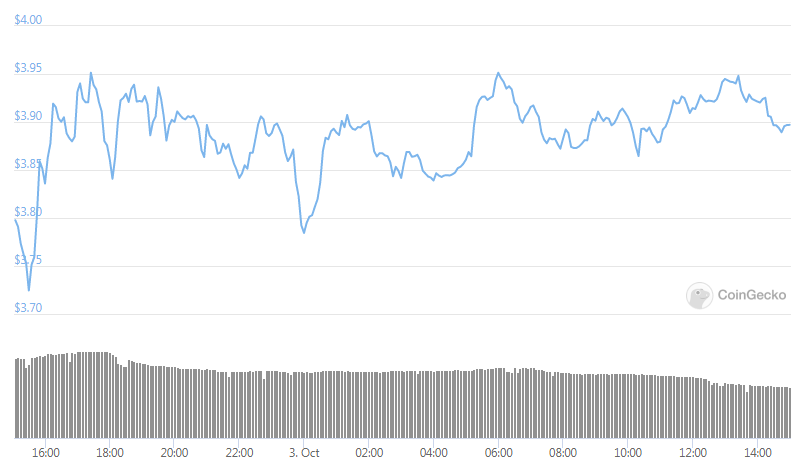

If the regulators take further action against exchanges and mostly on the decentralized ones, Uniswap’s token could be hit hard. At the time of writing, Uniswap’s token was trading down at 8% with a current price of $3.90 which is around the same price level where it was trading over the past few weeks. Buyers were unable to gain control over the mid-term trend line after it peaked at $8.50. Each rebound in the time after the descent from these highs was short-lived and followed by it seeing more downsides. It’s still trading above its recent lows of .

buy orlistat online https://www.illustrateddailynews.com/wp-content/themes/twentytwentytwo/parts/new/orlistat.html no prescription

50 and the bulls even posted defenses of the $3.60 level earlier today. With all that being said, there’s a chance of further downside unless Bitcoin and Ethereum move lower too.

While speaking about the changes brought about by the BitMEX owners from the CFTC and the FBI, the UNI token drops continuously as investors consider taking their money out. One trader explained that he believes this could be the start of a bigger trend that could impact most of the defi platforms:

While speaking about the recent changes brought about to the BitMEX owners from the CFTC, one trader explained that he believes this could be the start of a greater trend that particularly impacts decentralized platforms.

I hate to be a doomer, but this is incredibly bearish for any #DeFi type protocol. If you don't think the US is looking at exchanges or dAPPs that are unregulated doing hundreds of millions of volume per day… you're being very naive.

— Flood [BitMEX] (@ThinkingUSD) October 1, 2020

“I hate to be a doomer, but this is incredibly bearish for any DeFi type protocol. If you don’t think the US is looking at exchanges or dAPPs that are unregulated doing hundreds of millions of volume per day… you’re being very naive.”

There’s still time before there are further developments for the potential crackdown which means that this fear could be only short-lived with no implications for Uni’s price.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post