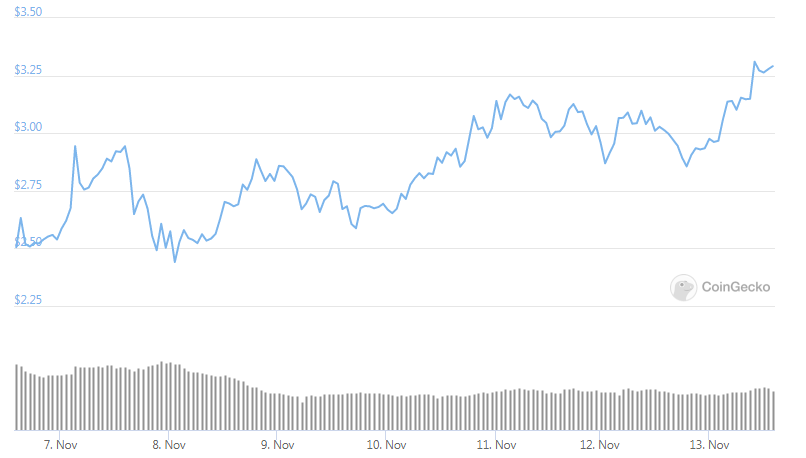

UNI overextension could start a sharp retrace as the token was trading in close tandem with the rest of the DeFi assets over the past few days. in today’s altcoin news, we are looking into the price analysis of the token.

Usually, this bodes well for UNI and it has faced some pressure due to the downturn across all DeFi assets with the decline coming about due to the BTC ripping higher as we can see in the charts. The investors are now cycling their recent DeFi profits into Bitcoin and these smaller tokens could continue pressuring the price until BTC is able to stabilize. Analysts are now noting that Uniswap’s token could be on the cusp of seeing more downsides noting that the lower $3.00 region’s selling pressure which could continue hampering the price and causing it to see more losses in the near-term.

One catalyst for UNI to see more upside is the end of farming incentives for the pairs supported around the time of the launch of the token. Farmers selling the tokens received from these pairs were suppressing the price action and once they are out of the picture, the Uniswap token could be able to catch some upwards momentum. At the time of writing, UNI’s token is trading down by about 3% with a current price of $2.89. This marks a notable decline from the highs of .

buy zydena online https://hiims.in/kidneycare/assets/fonts/flaticon/new/zydena.html no prescription

20 that were set around this time yesterday.

The resistance proved to be too much for the buyers to handle and there’s a chance that it will soon see more downsides with the start of the UNI overextension. Furthermore, Bitcoin’s upswing is placing more pressure on the Defi sector so unless BTC starts stabilizing it could contribute to the ongoing decline that is seen by the Uniswap token.

While sharing his opinion on where Uniswap’s UNI token could trend next in the near-term, one trader said that he is watching for a sharp downside movement towards $2.50. If it can find stronger support within this level, the DeFi sector will move higher and it could see a move past the local highs:

“UNI: To me it feels a bit over-extended although I think we’ll get one more small leg up into white box, which I’ll look to short and take into the lows if the midpoint breaks.”

Because UNI is seen as a benchmark Defi asset, the performance will match that of the entire sector that goes forward.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post