UNI and YFI shoot over 10% despite the recent Bitcoin rally as they are finally moving higher after the prolonged slump so let’s take a closer look at today’s altcoin news.

The two leading decentralized finance coins are up by over 10% in the past 24hours as they showed positive technicals and fundamentals for both. UNI and YFI are among the best performing assets of the day as the former is up by 22 percent in the past day while the latter was up by 10% over the past day as well. Bitcoin is up by 2% in the past 24 hours as it failed to hold above the $29,000 level during the recent rally on Wednesday evening. UNI’s rally seemed to be based on technology trends. Trader and DeFi analyst “degenomics” shared a chart showing the breakout yesterday and noted that UNI had a hard time passing $4.20 resistance ever since the initial launch rally. UNI is up by 22% in the past 24hours after breaking this level and is moving higher.

The rally represents a strong breakout of the resistance and could indicate that there’s more upside for the ETH-based coin. While the rally seems to be predicated on the technical trends, some argue that there’s an underlying fundamental reason as well. ETH is a scaling solution that works with Uniswap so it is expected to launch in the coming months as positive technical developments are announced regarding the project which is expected to reduce the transaction fees and to increase the transaction throughput.

$UNI has struggled with $4.20 for more than a month.

This is its 5th re-test. Will it finally break out?

Note the anchored VWAP which has acted as resistance every time and is declining (and flattening) pic.twitter.com/Ar7J0Lh8AB

— Degenomics (@degenomix) December 30, 2020

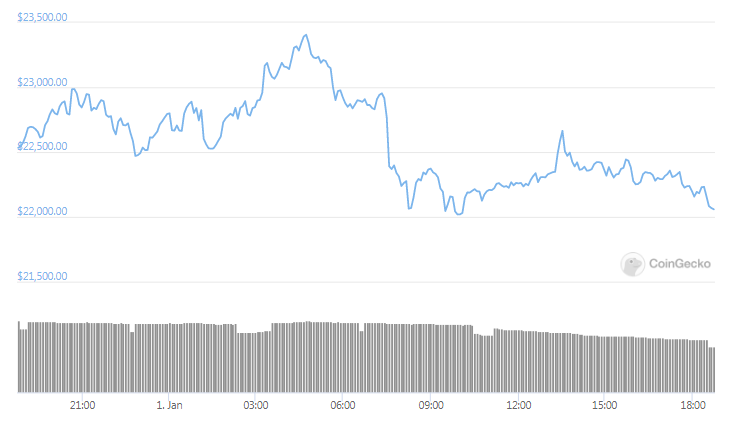

The upgrade is expected to send Uniswap to the next level. The SNX token is one of the few tokens which were affiliated with the Optimistic team at the moment being 50% in the past two weeks. The launch of Optimistic Ethereum could be catalyzing these rallies in the two assets. The native Yearn.Finance token surged from $21,000 to $23,000 but this corrected to the lower $22,500 region. the cryptocurrency is moving higher with Andre Cronje who is the founder of the project starting to test a new product called yCredit or StableCredit which he hinted a month ago.

He started minting a new token called yCredit and started to list the pairs pertaining to the crypto on SushiSwap a partner protocol of the Yearn platform. StableCredit is expected to be synthetic and a decentralized lending platform:

“StableCredit will enable users to deposit assets as collateral and obtain a line of credit (denominated in StableCredit USD) based on the dollar value of the assets at deposit. For example, a user can deposit 100 LINK and will obtain $1,100 worth of StableCredit USD (at the time of writing LINK is ~$11). StableCredit USD can then be traded for other assets available in the protocol.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post