UNI and LINK crash by 8% as DEFI tokens crash too with the total value locked in the DEFI ecosystem trending downwards so let’s read more today in our latest altcoin news.

Cryptocurrencies related to decentralized finance dropped today with the total value locked in DEFI ecosystems trending downwards. A few DEFI cryptocurrencies like Unisap and SUSHI as well as 1Inch and LINK suffered losses over the past day. UNI and LINK crashed the most. UNI as a token of the decentralized exchange Uniswap dropped over 8.7% in the past day and is now trading at over $5 with the token being the 22th biggest crypto with a market cap of $3.7 billion UNI dropped 88% from its ATH recorded back in May 2021, at $44.97.

The decentralzied oracle platform Chainlink’s LINK Token also crashed and it is down 8.3% over the past day so LINK is now used by users to run oracles on the Chainlink platform. The oracles for important data bridge between the off-chain and the on-chain events and now LINK is changing hands at $6.54 down by 87% from its ATH of $52.88 that was recorded in 2021. SUSHI as the token powering the SushiSwap DX dropped by 7.8% in value over the past day and now trades at $1.50 down b 90% from its ATH in March 2021.

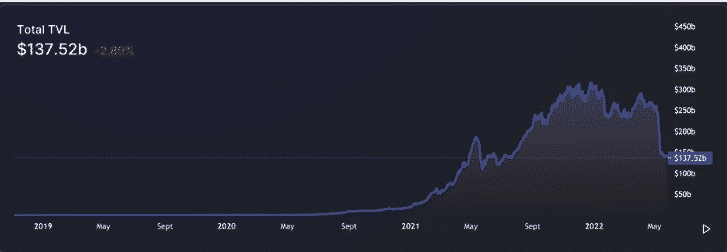

1Inch is the 98th biggest crypto with a market cap of $377 million and also dropped by 6.8% in the past day so now it is trading at $0.91. the main driver behind today’s bearish price action is a sudden drop in the total value locked acorss different DEFI protocols that are fueled by Ethereum’s price crash. The second biggest crypto by marekt cap Ethereum is down by 6% on the day with 5% in hte past week. The total value locked on all DEFI protocols now stands at $139 billion compared to $249 billion in May 2022. despite Uniswap reaching a total lifetime volume of $1 trillion, the UNI Token is in a downtrend.

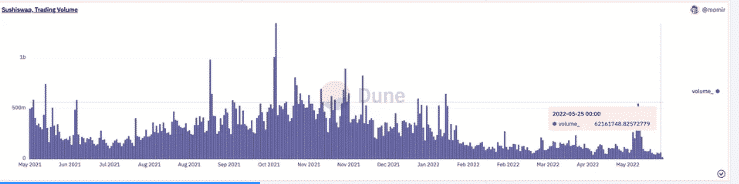

According to DUNE analytics, the weekly trading volume at Uniswap dropped to $3.9 billion a week ago, down from $10 billion in the past week. The volumes crashed to levels not seen in December 2020 which indicated a reduced interest in DEFI. Sushiswap’s monthly active users dropped from 70,000 in April to 60,000 in May and the MAU hit an ATH of 170,000 that was recorded in 2021 as per Dune analytics. The trading volume on the DEX also dropped to $6 million a day ago from a new high of $1.34 billion last November.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post