Traders seek shelter in Sushiswap’s SUSHI as the crypto market lost $25 billion and Sushi provided a buying opportunity for the traders so let’s read more about in today’s altcoin news.

The SUSHI/USD exchange rate increased by about 24% from the intraday low of $12.80 and the traders spotted a chance in the relative strength indicator for the coin that flashed oversold signals, They raised the bids to offset the losses somewhere else in the crypto market. It seems that gains on the Sushi market coincided with the drop in BTC, ETH, and other high-cap digital assets so on the whole, the cryptocurrency market lost more than $25 billion with Stellar, Ripple, and UNI marking the highest losses.

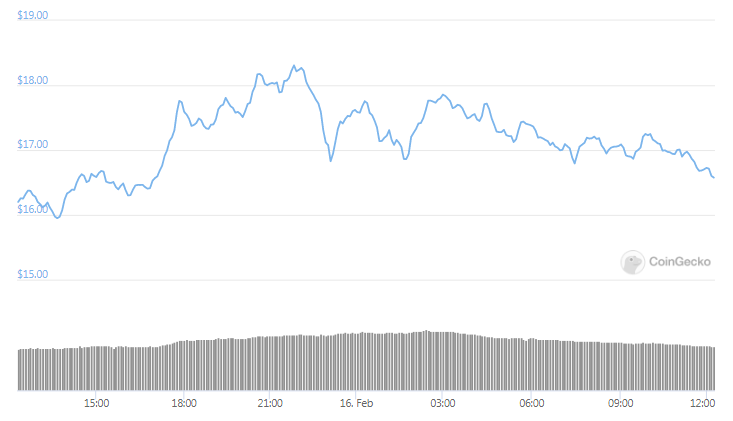

Technically, SUSHI bounced back as it tested a confluence of two support levels so the first price floor seemed to be an upward sloping trendline which constituted as ascending the channel pattern while the second footing came from the 100-4h simple moving average wave of the cryptocurrency. The rebound opened the Defi token prospects to the extending upside move to $17.61 which was the previous high recorded, followed by a run-up to the ascending channels’ upper trendline which sits at $18.80 and $19.00 range.

Michael van de Poppe, the popular market analyst, noted that SUSHI Could drop to deeper levels if it fails to hold the $14.50 and the $14.75 as an interim support range:

“If that fails to hold for support, further downwards momentum is expected and confirmation of the bearish divergence. Looking at $12 and $10 next.”

The latest upside rally pushed SUSHI’s token year-to-day gains up by 470 percent and the traders then started entering the SUSHI market owing to the representation for a DEX. Most retail traders that got frustrated with the stock trading restrictions on the platforms like Robinhood, turned the attention to centralized and decentralized exchanges. As traders seek shelter in SUSHI, the volumes on crypto trading platforms surged as well and their native tokens experienced a spike in demand which turned into a massive bull run. For example, Binance’s BNB reached a high as well to $148 last week.

SUSHI seems to have benefited from the same enthusiasm that entered the market this week so it is important to notice that the token was in the underbought territory but it posed a better opportunity for traders that are seeking short-terms safe havens against the crypto’s market downside.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post