Some of the top-tier centralized exchanges extend their market share in 2022 as we can see more today in our latest cryptocurrency news today.

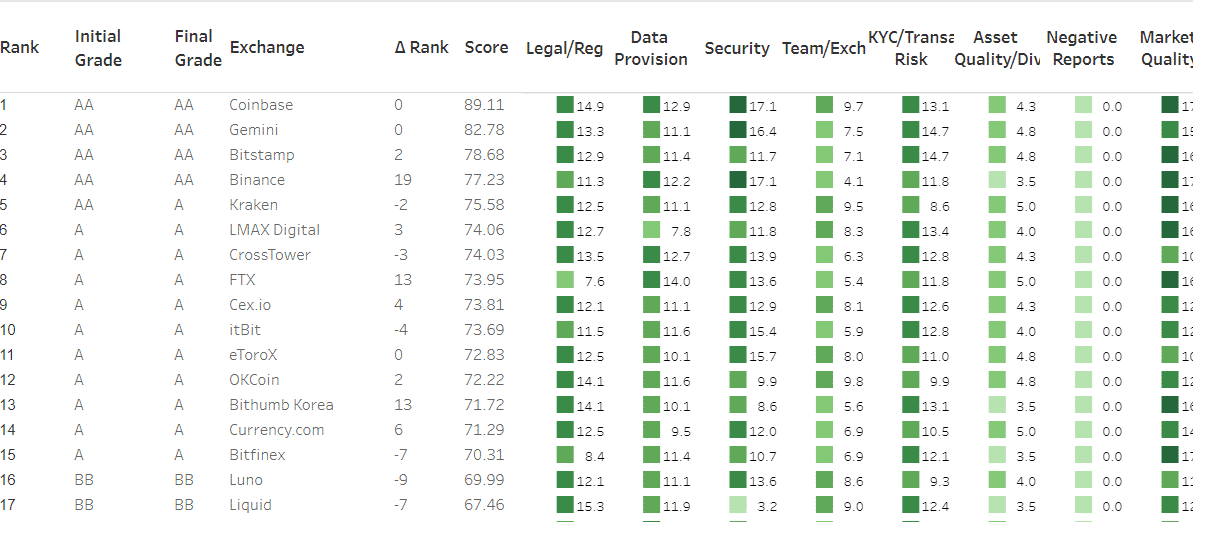

The top-tier centralized exchanges reached an ATH for market share this year with the trading volume in crypto consolidates ont the platforms of a few trusted companies. Some of the exchanges increased their market share from 89% in August 2021 to 96% in February as per the data from UK analytics company CryptoComapre. The company analyzed over 150 active centralized exchanges that ranked them on security and number of assets available, KYC checks and grades them from a top score of AA to a low of F with the top tier receiving a B or higher.

A total of 78 exchanges recieved a top tier grade with Gemini, Coinbase, Bitstamp, and Binance getting the AA Grading. The reports show that these exchanges traded a total of $1.5 trillion compared to the $62 billion in the low-tier exchanges which is a metric that CryptoCompare claims showed both the retail and the professional traders are getting into a lower risk exchange setup. The consolidation of the exchanges happened thorugh both exchange closures and the acquisitions from other and bigger exchanges. These top exchanges are eyeing overseas expansion and acquiring already licensed and smaller exchanges that operate in the country o interest as was the case with the FTX acquisition of the Japanese Liquid Group exchange recently.

The company reported that since 2019, 54 exchanges closed due to being uncompetitive in the market and causing further consolidation of the users to the top-ranking exchanges. China’s crackdown on crypto saw 6 Chinese-based exchanges shut down with the analysts noting:

“As we have seen, volumes have started to become concentrated amongst the top tier exchanges, and this is a trend which is bound to continue into the future. As the industry matures, we expect there to be an oligopoly of exchanges dominating trading volumes as their traction accelerates and smaller players are left behind.

buy cipro online https://royalcitydrugs.com/cipro.html no prescription

”

The report surfaced a few challenges which lay ahead for the crypto exchange industry and outlined the political pressure put on the exchanges to enforce Russian sanctions as the area that can see more action:

“While many exchanges have resisted this pressure, this political factor is an important risk to consider for the future of exchanges.”

The movement of the crypto users who prefer self-custody of assets was an issue flagged in the report:

“The mantra of ‘not your keys, not your coins’ is growing stronger amid the political pressure received by exchanges.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post