Terra’s UST stablecoin flipped BUSD to become the third biggest cryptocurrency and its trading volume is still around one-fifth of the one of the Binance digital dollar so let’s have a closer look at today’s latest altcoin news.

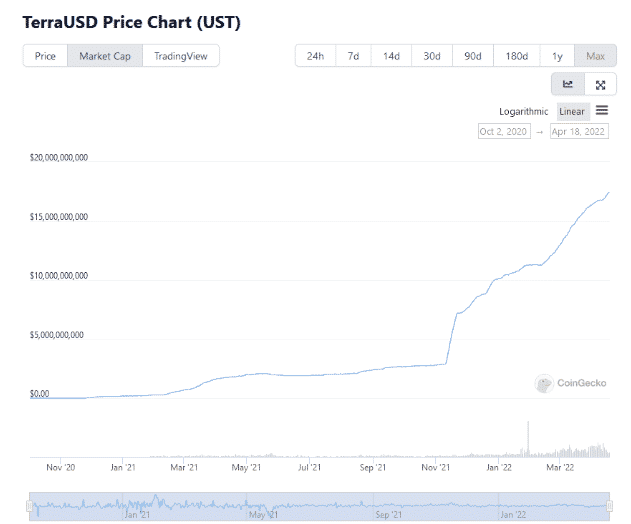

Terra’s UST stablecoin flipped BUSD to become the third biggest on the market UST is a USD-pegged stablecoin that was launched in 2020 and the minting mechanism requires a user to burn the reserve asset such as LUNA to mint the equivalent amount of UST. According to Coingecko, UST’s total market cap surged by 15% over the past 30 days and sat around $17.5 billion the figure now places UST as the third biggest stablecoin as it flipped BUSD with a lower market cap of $17.46 billion. The asset is trailing behind the industry giants Tether with $82.2 billion and USDC at $50 billion and the gap is quite substantial at this level.

According to CoinGecko, the market value of Terra's stablecoin UST reached $17.5 billion on April 18, surpassing BUSD's $17.4 billion, becoming the third-largest stablecoin after USDT and USDC. But UST’s trading volume is very low, only 1/5 of BUSD.

— Wu Blockchain (@WuBlockchain) April 18, 2022

The data shows that UST has been on a huge pump since mid-November with the market cap rising by 525% since then. Despite flipping BUSDS in the terms of market cap, UST is trading in volumes below the immediate competitor with Binance’s stablecoin seeing $2.26 billion worth of trading volume in the past day compared to the UST’s $431.79 million, and Terra has been making headlines of late in part to co-founder Do Kwon who vowed that the project will accrue a stunning $10 billion worth of BTC to back the UST reserves.

Most like the wider market of late, however, the bullish announcement are doing little to push the price of LUNA and the token price is down 12.4% over the past 30 days at a level of $77.31 while it also got down 34.4% to the brief all-time high of $119.18 back in April.

The last time he made a BTC buy was at the end of March and added $135 million worth to the reserve with LUNA hitting an all-time high of $106.14 but this wasn’t the case today. The crypto market dropped by 6% to $2.1 trillion and left a trail of red across the top coins with BTC crashing by 5% and ETH by 7%. Solana also dropped by 12% according to CoinMarketCap. After setting a new high of $119 on April 5, the LUNA price dropped by 8% after Kwon announced he would sell all funds to the BTC reserve. It was not enough to drop LUNA from the top 10 and the $37.6 billion market cap made it the seventh biggest coin as of Wednesday afternoon. Kwon said that establishing an all-BTC reserve for LUNA Will open a new monetary era for the BTC standard.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post