Terra’s UST market cap could soon flip the one of Maker DAI and will become the fourth biggest stablecoin by market cap due to the fast adoption rates as we can see more today altcoin latest news.

The stablecoin for the Terra ecosystem is a step away from flipping Maker’s DAI to become the fourth biggest stablecoin by market cap. Terra’s UST market cap sits at $8.78 billion whereas DAI corners $8.82 billion of the market and UST enjoyed a strong upwards momentum as of late. Over the past 30 days, the market cap of Terra’s UST stablecoin increased by over 90% and compared to the DAI’s 3% growth, it is evident that a flipping is imminent.

Terra is a stablecoin creator which means that you can use it to mint fiat-pegged stablecoins and there are a lot including TerraEUR and TerraGBP. The blockchain is built using software developer kit from Cosmos which is also an interoperable blockchain and it is currently the fifth biggest layer 1 smart contract enabled network behind Solana, Cardano, Ethereum and Polkadot. Terra’s stablecoins aren’t backed by typical methods and unlike the two leading stablecoins that are backed by cash reserves, Terra’s stablecoins are tied to LUNA.

Whenever users want to mint UST they will have to burn the equivalent of a dollar in LUNA which is the same mechanism when the users want to mint LUNA but they first have to burn UST. Maker’s DAI on the other hand is backed by over-collateralization so in order to create DAI, users have to lock more than 100% of the value of DAI that they want to create using other crypto assets such as USDC and Ethereum. TErra’s market performance is not just a product of the sucess UST had as a relaible stablecoin but the issuer’s native LUNA currency also exploded recently.

At the start of the month, LUNA charged into the top 10 crypto assets with the price hiking by 58% overnight. One of the main reasons behind the price rises came from doubling down on the network’s burn mechansim. The first initaitive was a protocol upgrade called Columbs-5 that moved to destroy LUNA when minting UST.

buy flagyl online https://royalcitydrugs.com/flagyl.html no prescription

The LUNA was moved to a pool to fund different Terra developments but the second proposal was made by the Do Kwon founder to destroy the remaining LUNA in the fund which was gathered before Columbus-5.

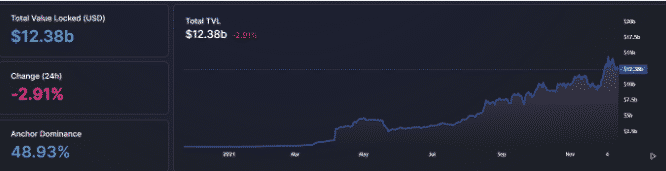

Alongisde the LUNA burning DeFi protocols on Terra are showing up from all sides and just like Ethereum, stablecoins are the main component of Defi and crates even more demand for UST. Around $12.3 billion of Terra is already locked up in more than 10 different Defi Protocols. If you partner that with the rate at which UST is being minted, it’s fair to say that Terra’s stablecoin is a mainstain in Defi and the wider crypto market.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post