Terra’s UST flipped DAI and became the fourth biggest stablecoin after weeks of tracking the stablecoin so let’s read more in our latest altcoin news today.

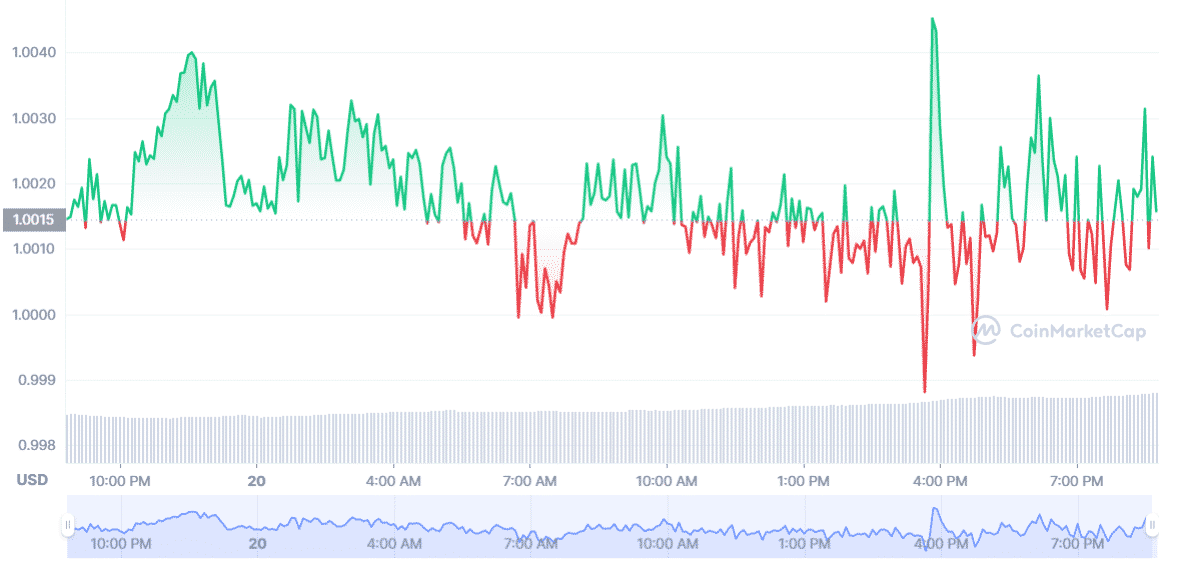

Terra’s UST flipped DAI and it is now the largest decentralized stablecoin and the 4th stablecoin overall. Terra’s UST overtook Maker’s equivalent DAI and the former now boasted a total market cap of just over $9 billion while the latter is still below this range. This makes UST the no.4 stablecoin on the market but it is very different from the three stablecoins that sit above it. While top stablecoin Tether and USDC are in command of the market caps of $77.1 billion and $41.9 billion both assets are run by centralized entities.

The circle is the company that issues USDC and Tether Limited is controlled by the owners of Bitfinex are the one that issue USDT. The third biggest stablecoin is Binance bUSD is pegged to the dollar and has a market cap of $14.6 billion. The assets backing USDT and USDC are centralized and made up of various traditional instruments such as US Treasuries, corporate bonds, and cash to name a few. BUSD Is backed 1:1 by dollars which are custodied by Paxos.

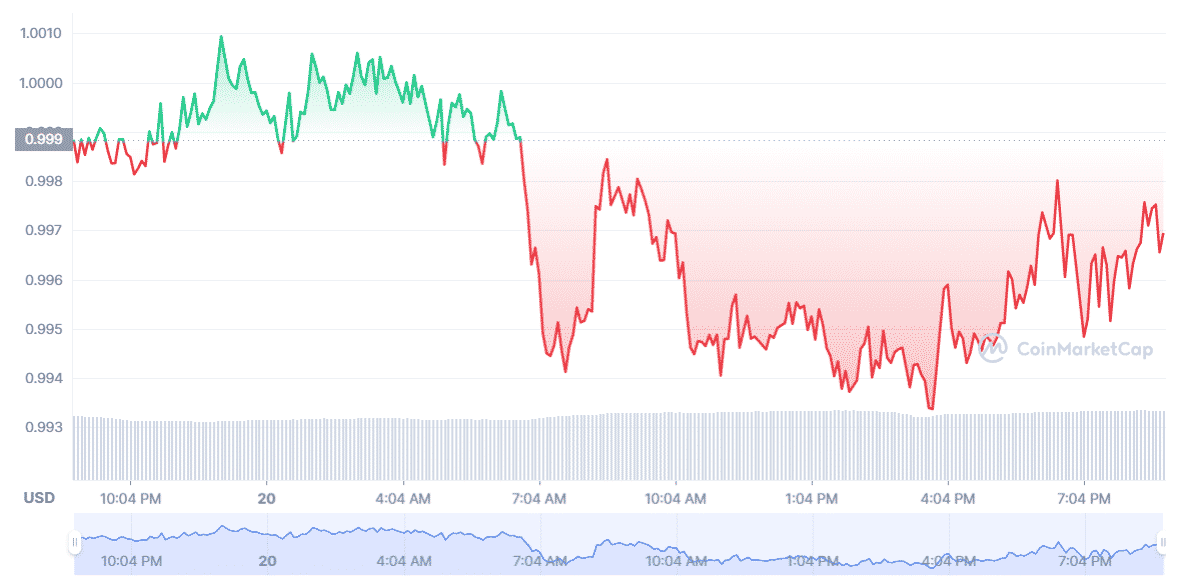

UST and DAI market themselves as centralized stablecoins and are backed by other cryptocurrencies which makes it even harder to block the underlying asset that help keep each stablecoin pegged to the dollar. The users can mint DAI by posting other cryptocurrencies as collateral akin to borrowing cash against stocks. Mining DAI means that the collateral posted is more than 100% of the DAI USD and you would need between $1.30 and $1.70 of ETH to use just $1 of the DAI. Terra’s UST is minted in a similar manner except the users can create more UST by burning LUNA. Terra itself is a layer-one smart contract that is built using the Cosmos software developer kit and it is the fourth biggest layer-1 smart contract enabled network behind Solana, Cardano, and Etheruem.

DAI was created in 2017 by MakerDAO and it is the market’s oldest operating decentralized stablecoin to exist. Terra’s UST was launched in September. Terra executed a huge upgrade that started off by destroying the LUNA needed to mint UST. Before this, LUNA was sent to a development fund to support the projects in the ecosystem. After that, the proposal was passed and destroyed all remaining LUNA in the fund to mint more.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post