Terra voted to burn 89 million LUNA tokens and right after the vote, we can see the LUNA price move strongly so let’s read more about it in the upcoming altcoin news.

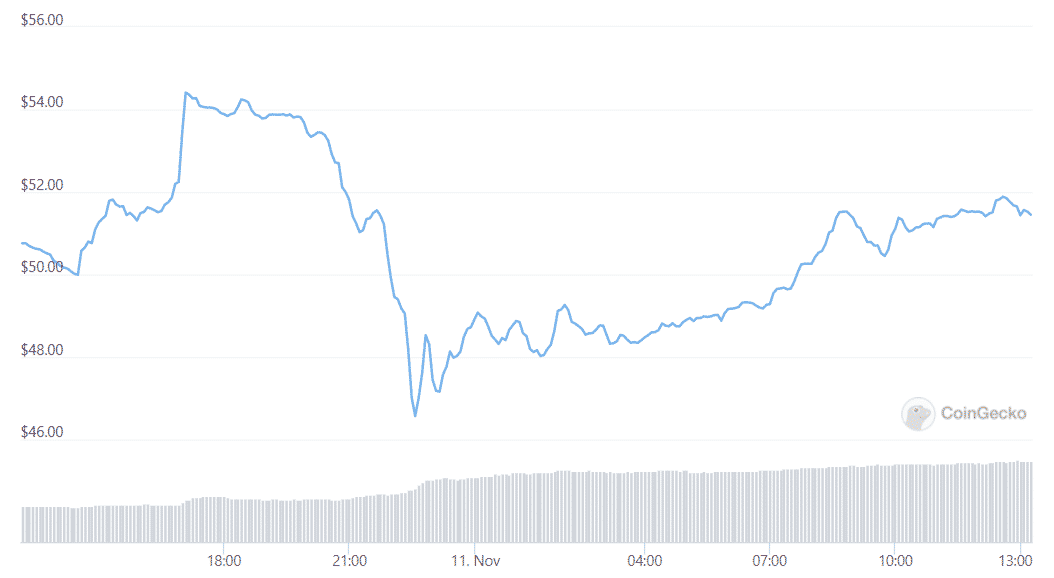

Terra voted to burn a huge percentage of the tokens and the price reached a record high before dropping. Nothing sparked high demand like the decreasing supply. Terra maintained the LUNA utility token protocol and the stablecoin developed by Terraform Labs. The community voted to burn about 89 million LUNA tokens worth $4.5 billion and after the proposal put forward by the co-founder Do Kwon passed, the token’s price shot up from $50 to above $54 reaching an all-time high of $54.77. it got caught up in a small market meltdown soon after as the entire crypto market turned red and in a few hours, the price dropped by 14%. LUNA has a market cap of $23.5 billion but since leveled off to about $48 so now the token has a primary use to maintain a 1:1 peg to the Terra algorithmic stable coins. More LUNA is minted when UST demand dips or it is burned when stablecoin demand rises.

1/ The on-chain votes for proposals 133 and 134 to burn the 88.675 million Pre-Col-5 $LUNA in the Community Pool (~$4.5 billion), swapping for $UST using the on-chain swap, and reducing the oracle_rewards_pool distribution window from 3 to 2 years have now passed!

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) November 10, 2021

After the successful vote, 520,000 LUNA were taken out of circulation with the remaining 88 million waiting to be burned over the course of two weeks that are expected to boost the value of LUNA even higher. The vote meshes with the larger plan that was laid out by the Columbus 5 network upgrade during late September which changed how and when the Terra protocol burns tokens. After the upgrade, instead of transferring LUNA to a community pool, LUNA used to mint the stablecoin that would be permanently burned and this move was designed to increase the value of the currency.

Kwon framed the token burn from the Terra community pool as revenue that generates an event to bootstrap the initial funds for the Ozone protocol. Ozone is insurance for using Terra’s burgeoning decentralized finance space that refers to lending, trading, and savings protocols that do away with intermediaries like banks and brokers. Ozone is here to manage the risk. Though Terraform Labs is based in South Korea, Its DeFi aspirations got in trouble. Kwon was served by the SEC while on his way to speak at a crypto conference in September and he sued the agency over the subpoena later which was in relation to TerraForm’s Mirror Protocol that allows people to trade synthetic versions of real-life stocks. Ethereum had luck burning its own coins and the London hard fork implemented EIP-1559 which is a measure that predicted transaction fees away from the miners that validate transactions into an inaccessible wallet where ETH is destroyed.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post