Terra surpassed Ethereum to become the second most staked asset as LUNA’s price surge helped in the process so let’s read more today in our latest altcoin news.

In addition, the data source reported the data showing that Terra surpassed Ethereum to become the second most staked asset which now has more than $28 billion in total value locked. According to the data report, the Terra crypto project has over 226,325 stakers and accounted for $29.5 billion worth of LUNA tokens that were staked which is how the token was pushed to second place and surpassed Ethereum.

Staking Rewards released a report showing that LUNA surpassed the ETH coin based on the network and the total value locked. From the data, LUNA had over $29.5 billion worth of tokens locked for staking while Ether has $25.9 billion worth locked for staking in the network. From the data, LUNA has over 226,325 token stakers and it increased the position toppling over four times the amount of ETH stakers that were 54,768 and it is now following hard after Solana with more than $35 billion total value locked.

LUNA is evaluated to reward the users with an average of 6.62% of the investments for annual staking revenues but ETH offers 4.81% in staking rewards that are lower than Terra’s staking incentives. Out of the top 10 cryptocurrencies, the crypto that brings out the most rewards is Polkadot with a 13.92% on average. The staking platform emphasized LUNA’s victory over ETH and some crypto users debated that the data from DefiLama contrasts with the figures. The DefiLama data shows that Ethereum is still above its competitors in TVL with a value of $111.4 billion.

On the other hand, LUNA’s total value locked accrued .

buy doxycycline online https://buywithoutprescriptionrxonline.com/dir/doxycycline.html no prescription

35 billion with the values including the total collaterals locked over DEFI protocols but not only staked ETH on the staking platform but the Beacon Chain showing differences. Beaconchain data shows 9.7 million ETH tokens staked and accumulates to $26.5 billion which tallies up with the data from Staking Rewards. A similar trend that the two aggregators show is that LUNA’s values increased.

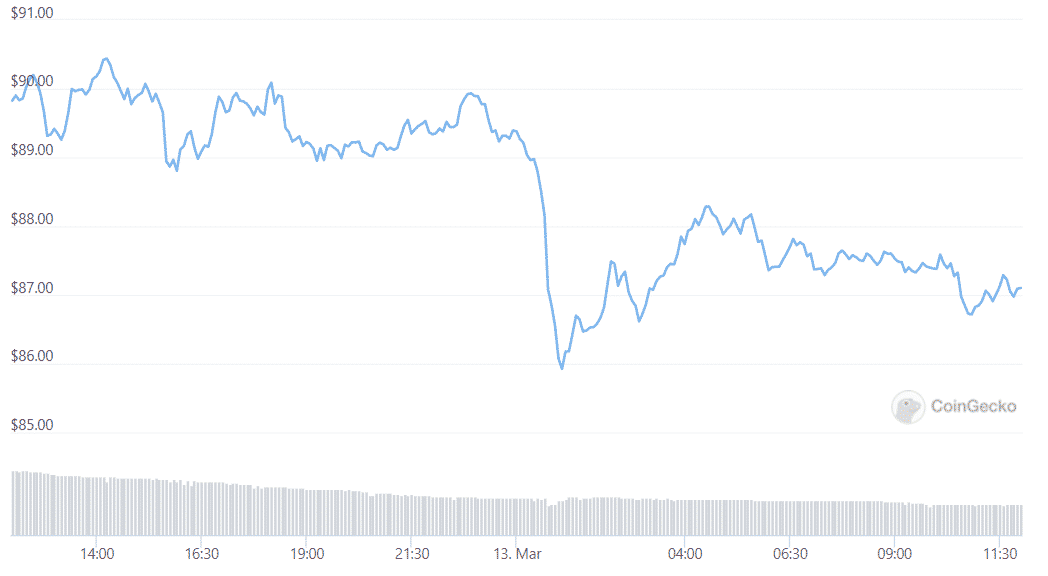

Within the last week, the TVL of LUNA grew by 26.905% and increased above BNB Smart Chian with a TVL worth $12.03 billion, coming in at a third place. The data aggregator Staking Rewards explained the difference between tVL metrics and staked value and the metrics include the total assets stored in the DEFI protocol for components like lending. Over the past month, lUNA’s price surged by 78.

buy lasix online https://buywithoutprescriptionrxonline.com/dir/lasix.html no prescription

4% and it is now trading at $89.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post