The Terra Classic tokens see volatile trading after some new developments on the market as the futures tracking the two tokens racked $18 million in liqudations in the past day which is higher than usual so let’s read more today in our latest altcoin news.

Tokens related to the Terra ecosystem saw some volatile trading in the past day amid legal developments against the issuing company Terraform Labs. The prices of the Terra classic tokens such as LUNA gained about 30% from $2.65 to $3.44 on Friday mornign and then dropped as the broader marekt remained flat. Luna Classic gained up to 34% before dropping the morning. Such volatility increased amid reprots of the US SEC investigating whether TErraform Labs violated the US laws regarding how it marketed these ecosystem tokens.

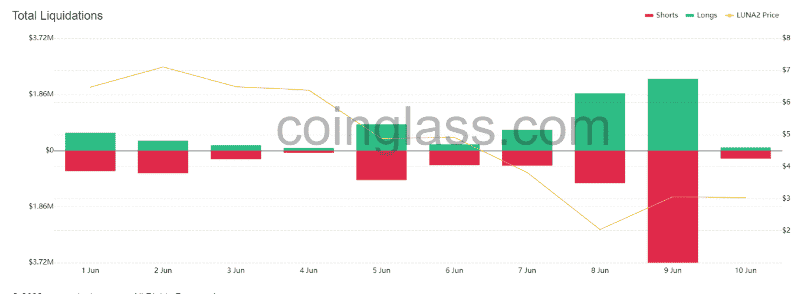

Futures tracking the two tokens saw $18 million in liquidations while the losses on futures or another crypto apart from BTC and ETH remained under $3 million. The LUNA was issued to holders in late May after the debug of the algorithmic stablecoin TerraUSD in May which is a move that saw the value of the old LUNA drop by almost 100%. The value locked on DEFI apps in the Terra ecosystem dropped by $28 billion. The liqudations marked the highest losses for traders of the new LUNA tokens and about $5 million in losses. However, LUNC futures saw higher losses at $12 million which suggested retail traders are continuing to prefer LUNC over LUNA.

Crypto companies ByBit and Binance are now the only exchanges to offer LUNA futures to traders while Huobi, OKEX offer LUNC futures. OKEx saw over $9 million in liqudations which is the highest among the counterparts. LUNA trades over $3.06 and LUNC trades over $0.00007647 with gains falling to 7% for the past day.

As earlier reported, Terra’s UST stablecoin could be the subject of a US SEC investigation. An unnamed source told Bloomberg that the SEC starts investigating Terra’s UST crash and they are looking into whether the way Terraform Labs marketed UST, the stablecoin violated federal investor protection rules. By definition, Terra’s UST should have maintained the US dollar peg and made it redeemable for $1 but unlike other stablecoins, UST relied on an algorithm and not the central user to maintain the peg. When the algorithm seemed to be enough, Terraform Labs called the Luna foundation guard and stepped into providing more backing.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post