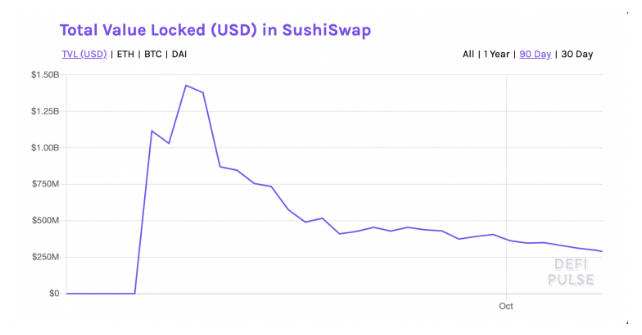

SushiSwap TVL, the total value locked in the protocol dropped by $1.13 billion after the price crashed as well, continuing the downtrend this week as well. Following our blockchain news today, we are reading more about the price analysis.

The Sushiswap decentralized exchange’s governance token continued its downtrend as the price fell another 15 percent in the week. As of 1130 UTC, SUSHI/USD was trading at $0.75 which is a drop of 94 percent from the record high of $12.48 which was achieved in September. The Sushiswap TVL suffered a major blow as well. The total value locked plunged from $1.428 billion to about $289 million today. The market withdrawals of about $1.13 billion in just a month according to the data by DefiPulse showed that the investors’ confidence in SushiSwap is declining.

Is it legal to dump this much? Found a worse performing coin than Ripple.

( -88% since DeFi hype bubble )$CRV pic.twitter.com/QLvA1BIdAU

— yTedd (@TeddyCleps) October 5, 2020

The higher total value locked represents that there’s more trust in the automated market maker industry which ensures that more people are willing to support the exchange by depositing the capital into the reserves. They anticipate strong incentives for that and steady revenue from the transaction fees as well as the governance rights by holding the native token. If the trust, however, disappears, the money will as well. People start withdrawing capital from the pool which means that they are reducing the exchange’s capability of processing trades faster when there’s not adequate liquidity. In turn, the revenue, as well as the appeal for these tokens, falls too.

SushiSwap faced severe trust issues with the liquidity providers since the founder Chef Nomi withdrew about 38,000 ETH from the protocol’s development fund. The media termed it as an “exit scam” even after the exchange’s head Sam Banknam Fried took over control. Nomi later returned the capital to the SushiSwap treasury but that was not enough to earn the people’s trust. Without the basic bullish fundamentals on the other hand, SUSHI risks getting exposed to volatile market trends.

For example, the SushiSwap token latest drop coincided with the rest of the decentralized finance market. every DeFi cryptocurrency that posted exponential gains is down on their knees. The traders are also profit-taking or moving their capital into projects that have long-term sustainability. SUSHI expects to tail the market trends but with no credible history of price actions, the token could undergo a free fall. Watching the liquidity pools in the meantime, we could only guess the next market move.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post