The Sushiswap newbie token has locked up about $1 billion in value while the coin is pumping to a new all-time high as we are reading more in today’s altcoin news and analysis.

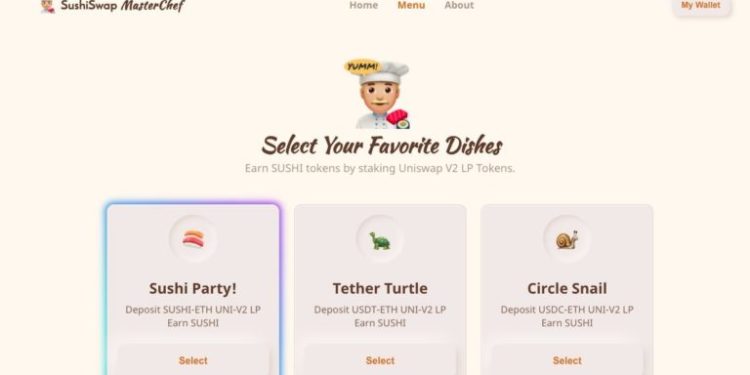

The Sushiswap newbie in the Defi space has locked up a nine-figure number in a few days after the launch. According to the data from the on-chain analysis company DeBank, Sushiswap liquidity miners have locked up altogether, about a billion dollars in the project. The goal is to create a liquidity pool on Uniswap with the tokens listed and come back to deposit these LP tokens for farming SUSHI.

The interest rates are unlike anything we have ever seen. The dashboard shows pools of different projects such as Chainlink, Synthetix, and Ampleforth that have 1000% annualized percentage yields for those who are interested in investing. SUSHI was on a roll as well as the data from Uniswap shows that the token saw a multifold increase in value since August 30. They are trading at $7.70 which is an increase from $1 from two days ago. With Sushiswap, the total volume locked of the Ethereum-based DeFi project exceeded the $11 billion mark. At the same time, sushiswap’s lock volume exceeded $1 billion and is now fifth in terms of locked volume. The top four projects are AAve, Maker, Uniswap, and Curve.

It settles down from the PoV of people providing their liquidity to collect coins, it crashes with tears from the PoV of people holding those coins that are getting printed nonstop to pay the liquidity providers.

— vitalik.eth (@VitalikButerin) August 31, 2020

The data from proprietary analytics pages shows the top 15 DeFi projects are all built on Ethereum although its founder, Vitalik Buterin is not a big fan. He said:

“The sheer volume of coins that needs to be printed nonstop to pay liquidity providers in these 50-100%/year yield farming regimes makes major national central banks look like they’re all run by Ron Paul.”

In the meantime, another possible catalyst for the SUSHI price was the crypto exchange FTX that announced the listing of the tokens. Both spot and perpetual futures markets are live on the exchange with a 3x leverage of the products SUSHIBULL and SUSHIBEAR that are trading for those that want to increase their bets without the woes of maintaining fees and margins.

https://t.co/xSJYK21y5J pic.twitter.com/85pAmluBre

— SBF (@SBF_Alameda) August 31, 2020

Uniswap hit its highest daily trading over $450 million as well which was propped up by the launch of Sushisawp DeFi governance token. The Uniswap opponent Sushisawp has to be audited still which means it could be a risky investment if things don’t turn out fine.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post