SushiSwap launches margin trading on the “BentoBox” product suite as of today as we are reading more in our latest altcoin news today.

SushiSwap is one of the biggest decentralized exchanges which is bringing lower-cost trading to the users and as of today, Sushiswap launches margin trading on the “kasha” app as a part of its BentoBox platform according to the announcement.

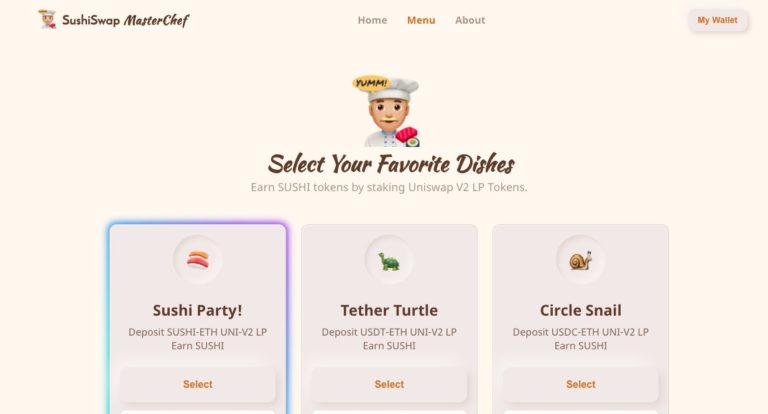

The DEX allows users to swap, trade, and lend assets via a non-custodian trustless platform where the traders are matched via a smart contract. The users can stake their tokens on the protocol in different trading pairs in order to earn yield from the fees generated by other traders on the DEX. Now things are going up a notch. Kashi is the first margin trading platform that is built on BentoBox and will allow traders to borrow funds from the protocol to place higher bets on assets. It will allow users to go short or bet against assets as BentoBox is a crypto token vault that generates yields from flash loans and strategies of its framework.

The vault is like a decentralized “app Store” where the users can deposit assets to enable other Dapps like maximizing the token yield generation via dual token usage and the in-vault tokens that can be used on other dapps. This will open up more avenues for users like earning yields on flash loans on Kashi and will earn interest in other DeFi protocols among other use cases. Sushi surged over 10% after the launch and it is now trading at $16 with a market cap of over $2.2 billion.

In the meantime, the Kashi upgrade brings another fundamental driver for the platform and marks the fifth largest DeFi app as per TVL on tracking site DeFi Pulse with more than $3.95 billion locked.

As recently reported, Anyone that used the ETH blockchain over the past few months was met with the high demand for Defi products and network congestion as well as transaction fees that are skyrocketing. For that reason, Avalanche welcomes DEX sushiswap to its team. The developers at Ava Labs believe that this move will help Avalanche grow and compete against Ethereum. Decentralized finance is the umbrella term for all blockcahin-based financial products that have no middlemen and encompasses things like loans, derivatives trading, and interest-bearing accounts.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post