SushiSwap jumps 15% after the news that it leads Uniswap in moved value across blockchains so let’s read more in today’s altcoin news.

The cost to purchase one SushiSwap governance increased by 15% in the past 24 hours. Dubbed as Sushi, the crypto established a new weekly high near $2.74 after a dramatic move to the upside. It now seems that traders flocked into the sushiSwap market as Sushi was trading close to a level previously which sent the price up by 38 percent.

buy tadora online https://paigehathaway.com/wp-content/themes/twentynineteen/inc/new/tadora.html no prescription

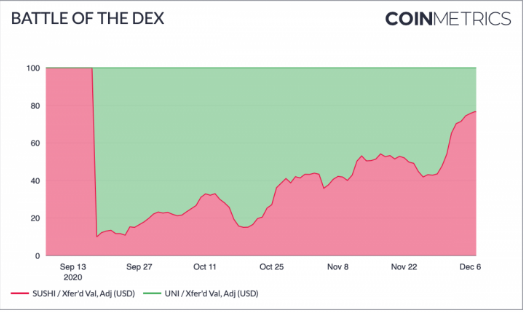

In the meantime, certain fundamental factors assisted the rally to the upside, including SushiSwap’s latest merger with the prominent decentralized finance project Yearn.Finance but also traders took cues from the growing lead over the top decentralized exchange Uniswap. Sushiswap jumps 15% as the latest on-chain data revealed that sushi moved more value across blockchain than one of Uniswap’s UNI token with the total value transferred being 70-30 lead over UNI because the former offers bigger support for liquidity than the latter. Liquidity mining is a process that offers protocol rewards for the users in native tokens.

Uniswap conducted a program for two months where it distributed 20 million UNI but discounted the program after the community voted against it. On the other hand, SushiSwap still offers liquidity mining rewards for its pools which drives up the SUSHI appeal in the short-term. The pair‘s exchange rate is trading inside the Ascending Channel consolidation pattern with signs of reversal upon testing the Channel’s upper trendline as resistance.

We can also expect to see the SUSHI price fall towards the Channel’s lower trendline which is a small opportunity for the traders that that will have to maintain a stop loss level above the resistance level. In the meantime, a breakout above the upper trendline will pump the price by another $1.07 which is the height of the flagpole which formed ahead of the ascending channel pattern that could lead the price of the token to $1.76 as its upside target. A breakdown below the lower trendline will risk the decline of the SUSHI price lower than $1.07 which would shift the downside target to $0.97 which was the level that acted as support during the downtrend action in November.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post