Over the past year, SUSHI multi-week highs were recorded thanks to the many partnerships that the platform made as we reported in our latest altcoin news.

Many expected that BTC will steal the show and set up a new all-time high but this was not the case as in October, many altcoins matched BTC’s rapid increase over the past few days and moved in tandem with the leading cryptocurrency. No other coin showed this as well as SushiSwap’s native SUSHI token did. According to the data, the coin increased by 24% since the trading session started and up about 35 percent in the past 24hours. This made it the best performing digital asset in the top 100 by market capitalization as it is trading for $1.90 which is the highest price level since September after the “rug pull.”

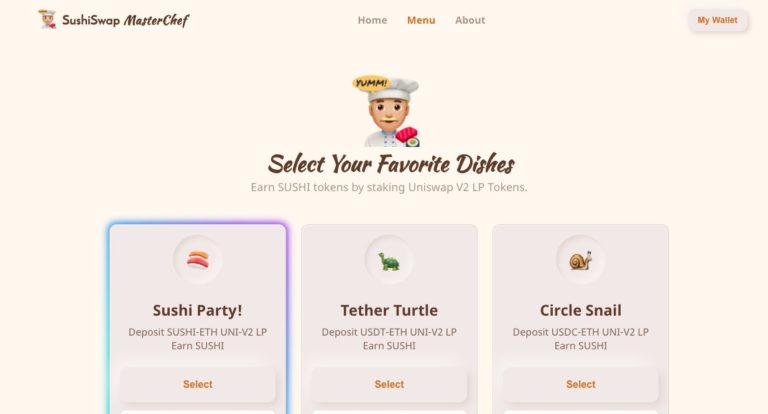

The rally is not a technical one despite SUSHI forming a technical bottom. The rally of the DeFi coins came as it was revealed that SushiSwap joined forces with another top ETH-based protocol yearn.finance in order to realize crucial synergies. This was the latest in YFI’s merger and partnership moves to bolster the products and the power of the deFi ecosystem as a whole. SushiSwap faced a number of setbacks since its launch but over the past few weeks it reversed and the market realized that the decentralized exchange established itself in the Defi space for sure.

Yearn x Sushi 行ってきます https://t.co/0sYZowfXsf

— Andre Cronje (@AndreCronjeTech) December 1, 2020

Andre Cronje, the founder of Yearn Finance announced that his team will now be joining forces with the SushiSwap team and will help realize the synergies:

“As Sushi focused on expanding their AMM ecosystem, and as Yearn focused on expanding their strategies, more and more overlap became apparent, Yearn needed custom AMM experiences for their strategies, and Sushi started pushing the boundaries of yield and money markets. With these overlaps, more and more work started to become mutualistic, and at this point, it makes to take the relationship to the next level.”

The SUSHI multi-week highs recorded, will only mean that the price of YFI is expected to rise higher. For context, YFI is multi-faceted Defi ecosystem that is mostly focused on yield farming and decentralized exchanges. SushiSwap on the other hand is a fork of Uniswap and aims to differentiate itself with the community focus and lending products. With the latest merger, SushiSwap will help Cronje’s new project dubbed Deriswap that aims to let people trade derivatives called options and to also take loans.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post