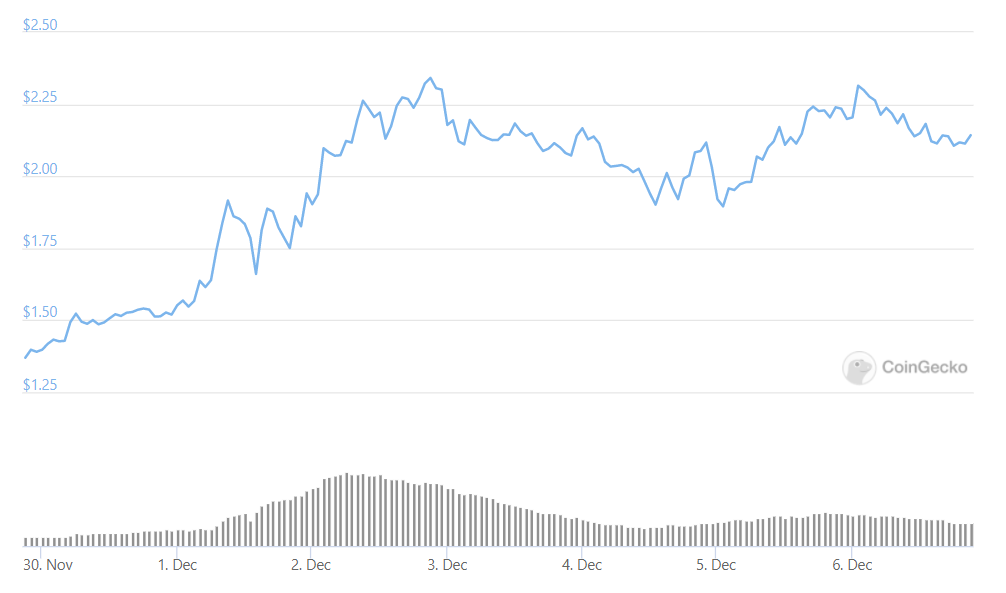

Sushiswap’s token SUSHI is surging higher again after Ethereum’s price started consolidating which reflected poorly for most of the other DeFi coins. SUSHI is now up by 20% in the past 24 hours alone and it made it the best performing token in the top 100 by market cap as we can see in the altcoin news below.

Sushi is surging at $2.30. The token continued to push higher and the move came because of the new merger/partnership with Yearn.Finance.

The merger recognized there are some strong synergies between the developers of the projects, as Andre Cronje, YFI founder wrote about the new partnership back in November:

“As Sushi focused on expanding their AMM ecosystem, and as Yearn focused on expanding their strategies, more and more overlap became apparent, Yearn needed custom AMM experiences for their strategies, and Sushi started pushing the boundaries of yield and money markets. With these overlaps, more and more work started to become mutualistic, and at this point, it makes to take the relationship to the next level.”

The two teams will now be working on a few other projects together. For example, Deriswap, the hyped decentralized exchange that mostly focuses on capital efficiency, will be working with SushiSwap’s developers. Other aspects of the protocol will also be integrated with one another to boost usability and speed. SUSHI is rallying on the launch of new products in the DeFi ecosystem as well. For example, Quantstamp announced that it had begun auditing SushiSwap for two main features like BentoBox and limit orders.

Limit orders will allow the users to trade on SushiSwap and BEntoBox will bring a solution for margin shorting DeFi tokens, oracles, and lending. Many are optimistic that the features will allow Sushi to be different from Uniswap which could result in a price boost and easier cash flow. As previously mentioned, The hype around the Yearn ecosystem drew huge amounts of capital to the Sushi token with investors sending the price skyrocketing higher over the past few days. The price was boosted by the huge influx of trading volume into the platform which came as the users started trading more DEX listed tokens in order to maximize the gains that started forming a new bull run.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post