In the cryptocurrency news today, we have a new update with a brand new token in the field of decentralized finance. We are talking about SushiSwap or SUSHI, which is a project that wants to take the concept behind the leading decentralized exchange protocol Uniswap and offer a better alternative with further incentives to liquidity providers.

An announcement from August 26th describes the project in detail, with a team of developers revealing more information about it. Overall, this initiative aims to become “an evolution of Uniswap with SUSHI tokenomics.”

The team behind SushiSwap has taken one of the main concepts behind UniSwap which is incentivized liquidity provision, adding further stimulus for those who decide to stake their tokens into the protocol. With Uniswap, the liquidity providers receive a share of the trading fees of the pool for as long as they provide liquidity on it.

buy vardenafil online https://littlehealthcare.com/wp-content/themes/twentynineteen/inc/new/vardenafil.html no prescription

Basically, SUSHI lets users to provide liquidity and receive fee rewards. However, they can also simply hold the native token and continue receiving part of the fees. This mechanism is similar to the one of Uniswap and goes like this:

- 0.25% of the fees go to the liquidity providers.

- 0.05% of the fees get converted back to SUSHI and distributed to SUSHI holders.

With Uniswap, liquidity providers receive 0.3% of the fees generated in the respective pool.

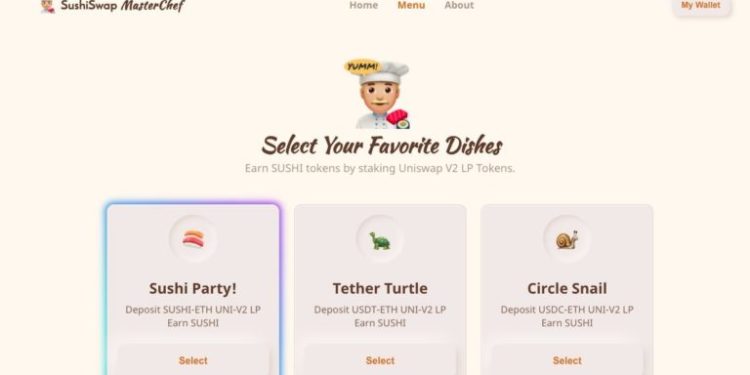

The official announcement shows that the SUSHI team is aware of the many liquidity providers in the Uniswap pools. Hence, they have made it possible to start providing liquidity and earning SUSHI tokens by staking the Uniswap LP tokens in a list of pools.

The pools here include CeFi stablecoins, DeFi stablecoins, lending protocols (COMP and LEND), synthetic assets (SNX and UMA), oracles (LINK and BAND), Ponzinomics (AMPL and YFI), and a delicacy pool receiving x2 rewards – SUSHI-ETH. For the initial phase, the protocol will be minting new tokens each time a block is mined on the ETH network.

As the Ethereum news also show, the idea is to create 100 new SUSHI tokens at each block, but for the first 100,000 blocks, the amount of SUSHI created will be multiplied by 10, which is why minting 1000 tokens is the amount per block.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post