Sushi dropped 14% while Ethereum tumbled under the $1000 price range over the past 24hours as we are reading more in the latest cryptocurrency news.

The leading decentralized-financed cryptocurrency became the worst performer in the top 100 coins by market cap. Despite the strong drop in SUSHI’s price, the coin remained up by 25% in the past seven days. With the 25% performance, the coin became one of the better-performing assets in the top 100 aside from NXM, Aave, Ethereum, Polkadot, Dogecoin, and SNX.

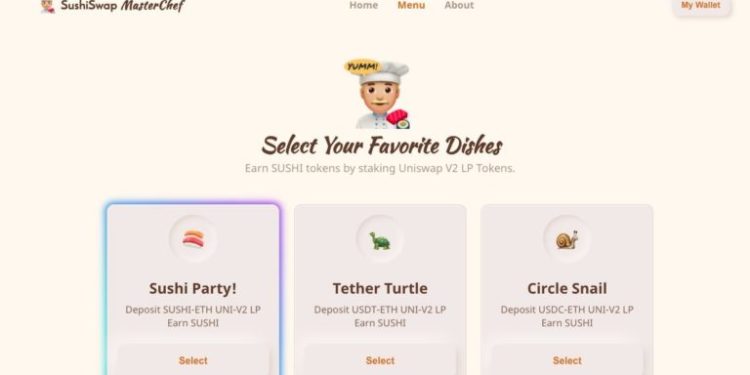

SUSHI Dropped 14% while Ethereum tumbled under $1000 while previously it traded below the key psychological level of the $1000. Sushi traded as high as $4.15 on the leading exchanges while ETH shot higher and the crypto started seeing large capital inflow from BTC into ETH then into these Defi plays as well. SUSHI’s price action remained volatile and started swinging between key price levels one after the other. The drop in the price of Sushi came in spite of the positive trends for sushiswap. A contributor to the protocol dubbed “BoringCrypto” explained that he is getting ready to release BentoBox. This will be a “Single vault that holds all tokens for a number of purposes” including money-markets for margin trading.

The first application for BentoBox will be a lending solution that will allow users to margin trade long-tail assets that are listed on SushiSwap. This is expected to be quite bullish for Sushi because the fees from this segment of the protocol will accrue to holders which will increase the price:

“The smart contracts for BentoBox are currently under audit by Quantstamp and Peckshield. The Peckshield audit is wrapping up with all issues addressed. The Quantstamp audit will probably wrap up in early January… Realistically, I’m hoping to see the first release go out in mid January.

The first release will give access to the basic features of BentoBox Lending for a predefined set of collateral-asset pairs.”

FYI SushiSwap just smashed its ATH daily trading volumes by a mile.

7 day trailing volumes now stand at ~$1.26bn

On an annualized basis xSushi stakers are earning $33m in fees. That puts $SUSHI at 13x trailing PE (16x FDV) pic.twitter.com/GnuqU3C6QZ

— Wangarian (@Wangarian1) January 3, 2021

Sushi’s rally yesterday came as the decentralized exchange recorded a new all-time high volume and total value locked, as we can see in the charts. Also, as reported yesterday, The usage of Defi platforms started increasing as well according to the data which indicates that the Sushiswap trading volume hit a new all-time high. As noted by Darryl Wang, the investment analyst at DeFinance Capital, the daily trading volume for Sushiswap hit a new all-time high of $355 million.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post