Solana’s TVL and price drop by 50% from their all-time high and the data shows that the decentralized app is fading out but there are some reasons that can prove to be hopeful so let’s read more in today’s latest altcoin news.

2022 has not been quite good for cryptocurrencies. Up to this date, the total market cap has dropped by 21% to $1.77 trillion. SOL’s correction was even more brutal and presented a 48.5% correction YtD. Solana’s TVL and price drop together as the coin leads the staking charts with $35 billion in value locked which is 74% equivalent to the SOL tokens in circulation. There are a few reasons that can be identified for the underperformance including the four network outages in 2021 and at the start of this year.

solana is cool for a centralized corporate state-sync machine… I just prefer real crypto and blockchain

— UltraXBT.eth (@UltraXBT) January 29, 2022

The latest incident was attributed to a distributed denial of service attack which caused the Solana labs developers to update the code that reject the types of requests. The investors are more concerned about the centralization caused by the costs of Solana validator so to achieve 400 millisecond block times, the recommended hardware includes a 12 core 2.8 GHx CPU or 256 memory with a low-latency internet connection.

Solana’s main dapp metric started to display the weakness earlier in November when the network TVL started to linger at $15 billion. The charts show that the Solana dapp deposits saw a 50% decrease in three months as the indicator reached the lowest level since last year. As a comparison, Fantom’s TVL now stands at $9.5 billion after doubling in three months but Terra, on the other hand, saw an 87% TVL increase to $23.2 billion.

On the bright side, FTX.US the American branch of the global crypto derivative and spot exchange FTX announced a new blockchain gaming and it is worth noting that Solana Ventures partnered with Lightspeed Ventures to launch a $100 million fund dedicated to the sector. To confirm whether the TVL drop is concerning, one should analyze Dapp usage metrics and some Dapps are not financially intensive so the value deposited is quite irrelevant. The decreased interest in the Solana Dapp was reflected in the futures open interest that peaked at $2 billion and then got hit with a sharp correction.

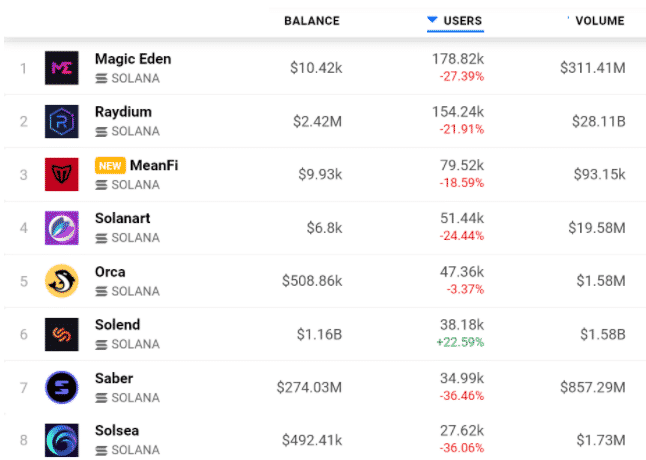

Even though Solana has been hit the hardest compared to the smart contract platforms, there’s a solid network use for NFT marketplaces as measured by Magic Eden’s 178,820 active addresses over the past 30 days. The data shows that Solana is losing grounds against competing chains but the holders are not concerned because most of the coins are locked in staking.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post