Solana Labs is targeted with another class-action lawsuit in California that was filed in court today as we can see more today in our latest blockchain news.

The lawsuit accused the company and entities related within the ecosystem of drawing illegal profits from the blockchain’s native token and claimed that SOL is unregistered security. The California resident Mark Young added:

“Defendants made enormous profits through the sale of SOL securities to retail investors in the United States, in violation of the registration provisions of federal and state securities laws, and the investors have suffered enormous losses.”

Solana Labs is targeted in the lawsuit as Young claims that he bought an undisclosed amount of SOL back in 2021. The suit stated that during the class period that started in 2020, the defendants that including Anatoly Yakovenko, the CEO of Solana Labs made misleading statements in relation to the SOL circulating supply. The court documents read:

“Since April 2020, funded by the proceeds they made through their [initial coin offering], Defendants have spent vast sums of money promoting SOL securities throughout the United States. As a result of these promotional efforts, SOL securities reached a peak price of USD 258 per token, with a market capitalization of more than USD 77bn, on November 5, 2021. These promotional efforts took SOL securities from a relatively obscure crypto asset to one of the top cryptoassets in the world.”

The plaintiff requested a jury trial in California and sought damages and a declaration that SOL is actually a security. One of the two law companies that represent the plaintiffs, Schneider Wallace said:

“Not later than August 5, 2022, which is sixty days from the date of publication of this notice, any member of the proposed class that is identified in Plaintiff’s complaint may move to the Court to serve as Lead Plaintiff through counsel of their choice.”

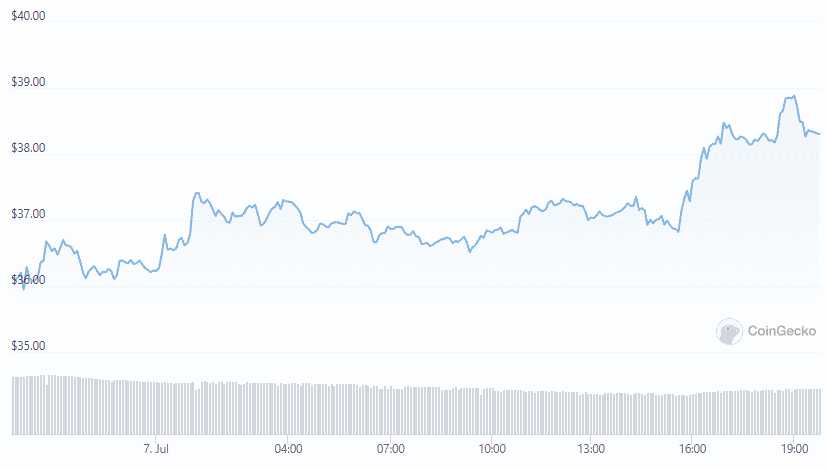

SOL ranked 9th by market cap on CoinGecko and now trades at $37 marking a 3% increase in one day. SOL is down by 13% in a month and up by 8% in a year but still remains down 86% from its ATH of around $260.

As recently reported, The $30 support level is where prices found support earlier this week and if this level is broken, the price could drop further. The bears were able to close a daily candle below the 20-day simple moving average which worked as long-term resistance. On the same night, Solana’s market cap fell below $11 billion which marks a 10% decline.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post