The SNX token rebounds quickly after the prolonged volatility over the past few days with the inflows of selling pressure coming due to the huge amount of SNX tokens stolen due to the recent KuCoin hack as we are reading more in the latest altcoin news.

The buyers were aggressive with absorbing this high selling pressure but have managed to push the cryptocurrency higher as its mid-term trend remains in strong control of the bulls. One analytics platform explained in a recent tweet that the on-chain technicals are showing that the cryptocurrency is incurring growing fundamental strength. This could allow it to see further upsides in the days and weeks ahead. One such metric which only outlines the strength is the number of active addresses and the tokens that are circulating on-chain.

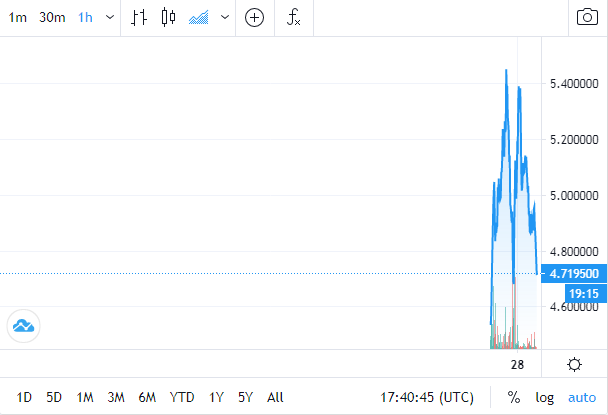

The confluence of strong buying pressure and the on-chain strength seems to show further upside could be imminent in the upcoming days and weeks ahead. At the time of writing, the SNX token rebounded after trading down just under one percent with a current price of $5.03. This marks a slight decline from the daily highs of $5.40 which was set at the peak of the recent upswing. Over the past weekend, SNX’s price dropped as low as $4.60 which could be driven by the inflows of the selling pressure from the hackers that stole plenty of tokens from KuCoin and the aggregated value of $150 million.

The fears about the hacker being able to crash the SNX token price seem to subside already. SNX is one of the major DeFi-related tokens which will continue tracking the overall market’s trend. Synthetix Network Token could be able to push higher in the near-term independently from the rest of the market as the data seems to show that it is fundamentally strong. Santiment spoke about this recently explaining that the on-chain circulation and the active address count are both showing imminent push higher:

“SNX has rebounded nicely over the past week (+19.4%). Network activity, such as on-chain circulation and active addresses, indicated a bullish divergence when it dropped to $3.55. Both metrics sustained high levels to allow price to jump back above $5.00.”

The bullish fundamental divergence seems to show that an upside move could be imminent. With all that being said, weakness in the aggregated market could invalidate the strength that this cryptocurrency had and bring the price lower.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post