The polygon price risks dropping as MATIC eyes an inverted cup pattern and the bearish technical setup has a success rate of 62% of getting to the downside price targets as we are reading furhter in our latest cryptocurrency news.

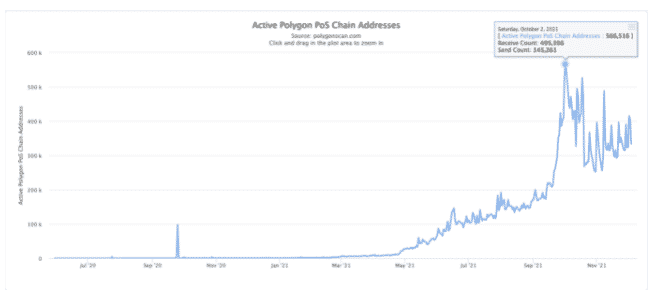

Polygon price risks dropping as the token already dropped by 40% from its record high of $2.92 back in 2021. But if a classic technical indicator is to be believed, the token has room to drop again in the next few session. MATIC’s recent rollover from bullish to bearish is followed by a rebound to the upside which led to the formation of what seems like an inverted cup and handles a pattern which is a large crescent shape followed by some extreme upside retracement as it can be seen from the charts. In a perfect scenario, an inverted cup and handle setup set the stage for the new downturn but as they do, the price tends to fall to levels that are at length equal to the maximum distance between the top and the bottom when it is measured from the breakout level.

If Matic breaks the bullish out of its handle range, a drop accompanied by an increase in volumes could lead to a fall towards $0.86 or about 50% below the current prices in the near future. Polygon’s bearish outlook emerged amid the broader crypto market correction in 2022. the top tokens like ETH and BTC lost about 22% and 11% of their make valuations year to date and their drop triggered similar downside moves on the market with an overall valuation falling to $1.878 trillion just two days ago from the $2,190 trillion at the start of the year.

Polygon’s market cap dropped to $12.96 billion from $18.10 billion and the MATIC price is plunging over 30% to $1.734 at the same time but the technical support confluence kept the token’s bullish hopes alive still. The two support levels in the form of MATIC’s 200 days EMA and a multi-month upward sloping trendline helped the token limit its bearish bias. The Polygon token has been testing the support confluence for a new price rebound ahead however it seems that the upside retracement will have MATIC retest an imminent resistance level above the negative sloping trendline. As a result, the bullish setup could emerge only on a decisive rebound with the prices rising alongside trading volumes.

If not, MATIC will risk validating the inverted cup and handle pattern above which has a success rate of 62% according to veteran analyst Tom Bulkowski.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post