Another blockchain analytics firm Polychain Capital purchased $2 million of yearn.finance’s YFI Token as the DeFi market underwent a strong surge since it bottomed out last week. As per the reports in our altcoin news, we are reading more about the latest purchase.

The top DeFi coins surged by over 100 percent from their lows becoming the best-performing assets of the past week. The on-chain data suggests that the recovery will be a byproduct of the large inflow of institutional capital into the crypto space. Nansen, the Ethereum-focused blockchain analytics firm found that an address was tied to Polychain Capital. Polychain Capital purchased a huge amount of YFI and the company is a leading crypto-asset venture fund led by Olaf Carlson Wee as the first employee at Coinbase.

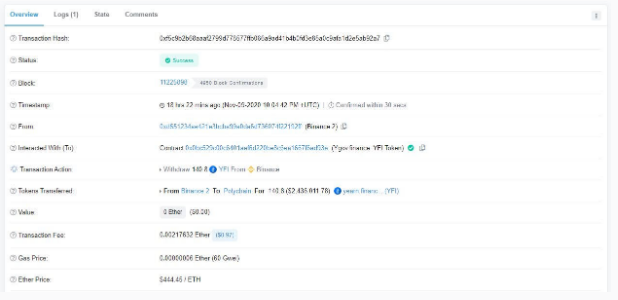

The company received 140.8 YFi which had a value of $2.1 million at the time the transaction was sent. The transaction came from the address affiliated with Binance which has one of the best liquid markets for the Yearn.Finance’s YFI token. The latest transaction came three weeks after Alex Svanevik, the Nansen CEO revealed that the fund acquired 329 YFI which was valued at around $4.6 million. Nansen uses these methods and heuristics to figure out the funds, investors, and firms and how they interact with different ERC20 tokens.

It’s still unclear when PolyChain made this purchase of YFI or at what price the fund got their hands of the cryptocurrency. There has been an effort to buy YFI on the exchange by en-masse by fund managers and the investors. Their goal was to liquidate a user which was short-selling the token. This short-squeeze happened a few days ago which boosted the YFI price higher by 140 percent in the span of 36 hours. It’s possible that the company purchased the tokens in the same timeframe helping to boost the rapid price action.

More evidence shows that the theory is that institutional money is fueling the rebound in ETH’s DeFi market. Nansen data also shows that Wall Street proprietary trading shop Jump Trading deployed about $4 million over the past week alone into Compound. The company owns $70 million worth of ETH altcoins and about $30 million worth of Serum.

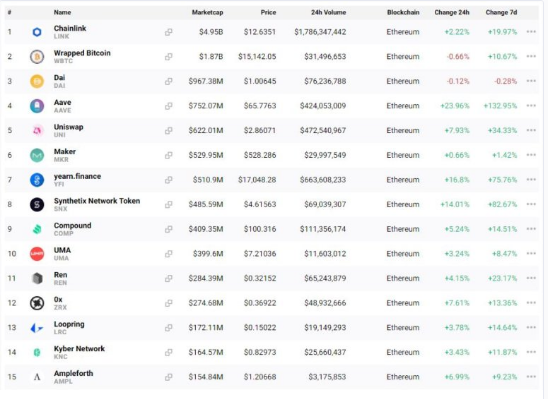

Fund managers in the space noted that they have been accumulating coins like Aave over the past few days, citing how the fundamentals of the DeFi space which are better than ever despite the corrections in the coin’s prices. This only shows that DeFi coins were a long-term value buy with the levels seen last week.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post