Perpetual Protocol becomes the sixth biggest DEX in one month of operation and the xDAI protocol spent just $183 on gas fees so let’s read more in today’s altcoin news.

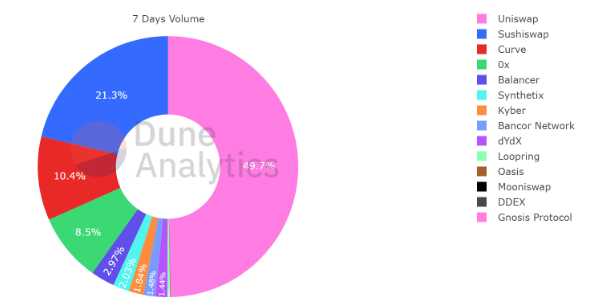

Perpetual Protocol is a Defi project offering a decentralized perpetual contract using the layer-two ETH scaling solution xDAi which emerged as the sixth-biggest DEX by weekly trading volume after it only operated for a month. Based on the data from Dune Analytics shared by Perpetual Protocol the DEX weekly traded volume of about 9 million will rank the project above Kyber, DyDX, and Synthetix below Balancer.

buy cialis strips online https://www.illustrateddailynews.com/wp-content/themes/twentytwentytwo/parts/new/cialis-strips.html no prescription

The milestone was shared in a blog post and celebrated the project’s first operating month, a period that has the DEX driving more than $500 million in total volume and generated more than about $500,000 in trading fees. The trading fees that were generated by the protocol are now sent to an insurance fund that is designed to secure this protocol with the protocol aiming for a divert of 50% of fees to PERP stakes once the staking pool launched.

In the blog post, the Perpetual contract becomes the sixth biggest DEX in only one month of operating and spent $183 to execute 179,000 transactions with the gas fees on xDai being one-one-hundredth of the ones on the ETH mainnet. With Perpetual Protocol covering the gas fees of the traders, the DEX will have to pay out $18,300 in fees if it was operating on ETH directly. xDai is one of the few L2 scaling solutions which are offering a new way and a new opportunity for heavy fees that are related to operating on the ETH mainnet with Synthetix launching the first stage of the transition to the optimistic roll-ups.

Congratulations to the @perpprotocol, just over one month old and already making some serious moves with trading volume surpasing 500M!

Running on @xdaichain, gas for more than 179K transactions was only $183! https://t.co/RiqoUY4xit— xDai Stake (@xdaichain) January 18, 2021

Looking ahead, the Perpetual expects to employ limit orders functionality in the first quarter of 2021 and will also launch staking in February. The Decentralized exchanges emerged as a cornerstone of the crypto ecosystem in the third quarter of the 2020 boom with the leading DEX Uniswap now processing about $1 billion in volume per day and surpassing a lot of centralized exchanges by trade activity. Despite the booming volume, the DEX sector is dominated by a few platforms only with half of the combined DEX trade activity taking place on Uniswap and about 90% of combined volume transpiring on the largest platforms on the market.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post