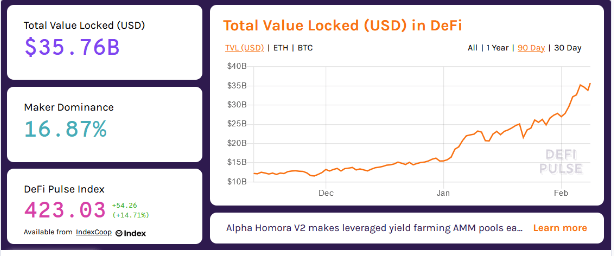

The parabolic growth brings the total value locked in DeFi at $35.8 billion and what’s more, it came about from lesser-known DeFi protocols which dominated the market over the past week as we are reading more in our latest cryptocurrency news.

The total value locked in DeFi is a high-level valuation metrics that determine the number of assets that are staked in the Defi space entirely:

“TVL measures the total value of the tokens locked within these dapps with the argument going that the higher the value locked up in a DeFi dapp, the better.”

Once DeFi burst on the scene back in 2017, the TVL increased exponentially at the end of 2018 when the TVL reached $300 million. By 2019 it was set at 0 million but at the end of 2020, it saw a strong year-end close of around billion.

buy Premarin generic https://noprescriptionrxbuyonline.com over the counter

The rate of the growth in time shocked plenty of observes that lead some to believe that DeFi is a bubble that will pop. Justin Banson, the CEO of Boston Protocol argued that the disruption of centralized finance will boost the growth:

“It is all about unbundling the tightly controlled monoliths of the incumbents and allowing the brightest and the best to build the products that are useful to them, while opening up access for everyone — not just the privileged few — to gain access to the data and opportunities that can give them the best returns.”

The parabolic growth has just reached $35.8 billion which marks a 132% growth in the past five weeks since the start of this year. Right now, the top three protocols are Compound, Aave, and Maker which account for $4.14B, $5.66B, and $6.03B of the TVL in DeFi which all three are lending protocols. The decentralized exchanges made up the next big category with Curve Finance $3.85 billion, SushiSwap $3.13B, and Uniswap at $3.67 billion.

The total market cap pushed to a new all-time high of $1.3 trillion with a huge chunk coming from the performance of the DeFi tokens over the past week. Maker and Aave did their part and gained 79% and 78% since Monday with small-cap offerings leading the charge. Anyswap which is a decentralized cross-chain swap protocol had 500% gains and registered a new all-time high of $1.51 while at the start of this year ANY was trading at $0.16.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post