Binance Smart Chain’s Pancakeswap became one of the top DEXs with a daily trading volume of over $400 million, boasting low-fee trading and quick transactions so let’s read more about it in our latest cryptocurrency news.

The rise of trading volume came as the traders were looking for an alternative to ETH-based DEXs. Pancakeswap became the leading DEX with $400 million in trading volume and it even briefly worked as the second biggest DEX by trading volume as the data from Coingecko shows. The project was written off by market pundits but emerged as an underdog as it grew higher and had $1.7 billion worth of crypto assets locked in the DEX.

— PancakeSwap 🥞 #BSC (@PancakeSwap) February 15, 2021

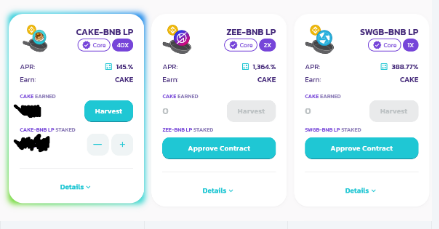

Pancakeswap started off as a Sushiswap imitation and provides liquidy to the platform while farming the SYRUP governance token. This arrangement was quite similar to many peer-to-peer exchanges that popped up in the past year offering bigger yields to the users that became liquidity providers and the chance to govern the platform but the newer products like NFTs didn’t quite further the use cases of the platform. As of today, there are over 176 markets on the platform and Wrapped BNB is the most traded market with over $81 million in volume over the past day. CAKE is next with a $45 million volume and other tokens like Burger Swap, Monster Slayer Cash and Birthday Cake follow up with smaller volumes.

Pancakeswap’s yield farms remain a draw for users and the liquidity pool for ZEE/BNB is paying out higher than 1300% to users per year. Considering the volumes are not fake, most of the success of Pancakeswap stemmed from the anonymous team choosing to create on the Binance Smart Chain that is built and maintained by the Binance crypto exchange.

buy cialis daily online www.ecladent.co.uk/wp-content/themes/twentyseventeen/inc/en/cialis-daily.html no prescription

The BSC network charges a few cents per transaction and it is classified as a high-speed blockchain that offers 300 transactions per second as per Binance’s CEO Changpeng Zhao. This is in contrast with Ethereum’s massive transaction fees and it has a much slower speed but it is far decentralized which means that the decentralized exchanges getting built on it pose potential risks.

The low fees are what makes Pancakeswap to more users and to anyone that wishes to trade a smaller sum up to $100 without paying 25% of the trading fees.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post