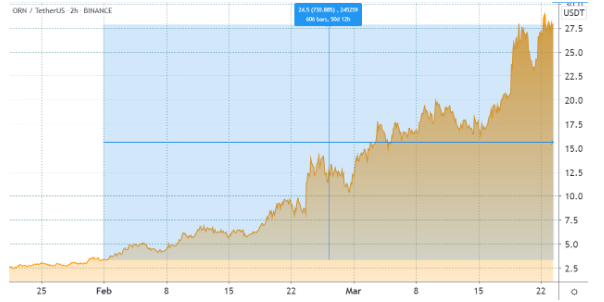

Orion Protocol rallied by 730% since February and hit a $500 million market cap but what is really behind the recent rally? Let’s find out in our latest altcoin news today.

With the DeFi industry growing, new exchanges and liquidity protocols are emerging constantly and for the average investor, keeping track of all of them and looking for the best yield opportunity became a hard task. The situation became even worse as the centralized exchanges started offering staking opportunities so the need for a liquidity aggregator which connects to several decentralized and centralized exchanges became clear. Orion protocol aims to provide access from one platform for users to trade and to swap pools.

Instead of competing with exchanges, the service aggregates order books and liquidity in one platform and the Orion Terminal will offer Binance and KuCoin trading without owning an account or fulfilling KYC Verification. Moreover, it will provide connectivity to both ETH and Binance Smart chain.

buy valif online http://www.biop.cz/slimbox/extra/new/valif.html no prescription

The Orion Terminal aims to go live on March 31 and on the news, Orion Protocol rallied by 730%.

According to the blog post, users will trade and will stake without having up their private keys by using Formatic and COinbase wallet as well as MetaMask. By depositing funds into the smart contracts, users will be able to trade across exchanges without having the need for more than one account. As for staking and liquidity pool aggregation services, the final testing and mainnet are expected for mid-2021 and the project now has more than 40 partners which brings more volume to the protocol and boosts potential staking rewards.

The expansion plans include leveraged ETFs, derivatives, NFT, lending, margin trading, and staking. This could sound enticing but it does promise a new wave of users and adoption and so far, similar terminals haven’t lived up to the expectations. In October 2020, Metamask launched its own decentralized exchange aggregation service and now the number of non-KYC centralized exchanges drops each year leaving no room for Orion to expand the services.

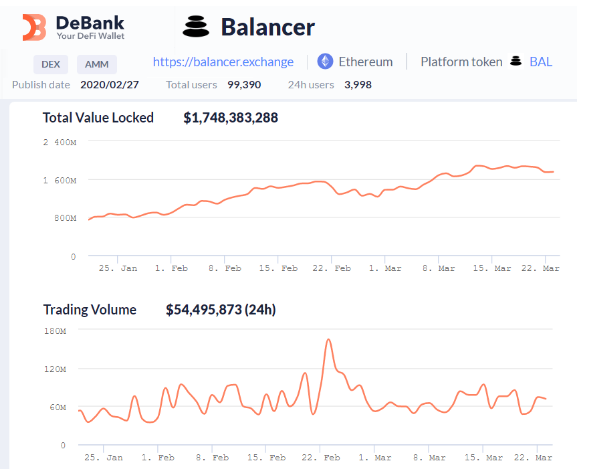

In short, DEX aggregation is a competitive sector and has almost no barriers. Therefore the ORN token could have priced some market share that may not come to fruition ever. As a comparison, the Balancer Protocol Governance Token hit a $1.7 billion total value locked and $50 million in daily average volume. BAL’s market cap stands at $743 million.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post