The OlympusDAO OHM token dropped 27% amid the latest crypto crash but so far the coin has proven to be up to the task so let’s read further in our latest altcoin news.

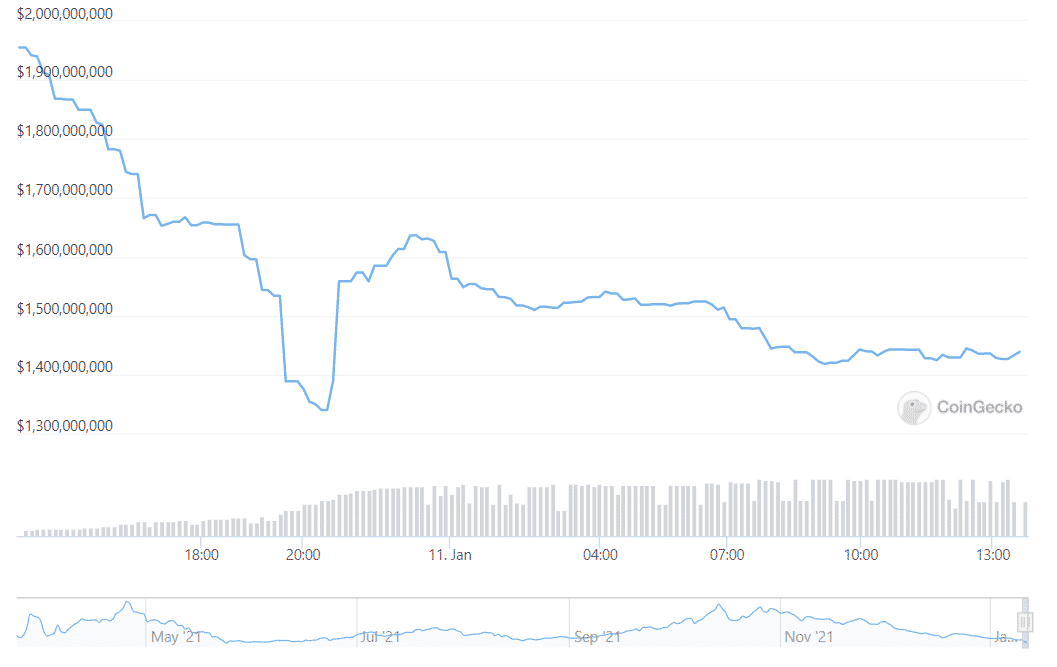

The OlympusDAO OHMtoken dropped by 27% over the past day to a price level of $180.03 amid a wider market crash. According to the data from CoinGecko, OHM dropped 87% from its all-time high of $1415 in April 2021. OlympusDAO is the protocol associated with the OHM token which recently took the world of DEFI by storm. The unique tokenomics has played a key role in defining the DeFi 2.0 meme which offers a novel approach to enhancing liquidity. In the past, the projects need to launch expensive incentives programs in order to attract liquidity. Once these programs ended, the liquidity would quickly move to the new opportunity. OlympusDAO and other DEFI projects offered an alternative to this model.

With its unique bonding and staking scheme, OlympusDAO allows users to buy discounted OHM tokens by using other liquidity provision tokens that mature over time as well as to lock up their tokens and earn APY in the token. This offers holders a huge incentive to lock up the accrued OHM so once locked, these tokens cant be sold which eliminates the selling pressure. At the same time, the protocol retains a hefty portion of the tokens and now OlympusDAO owns 99.99% of the liquidity for the OHM-DAI token pair.

Though the mechanism is unique, it doesn’t appear to be holding up the price of the native token. The influence however on the market has been notable. With the price action aside, Olympus’ design already had an outsized effect on the rest of the DEFI space. The offering is essentially a bonding as a service program that allows other DEFI protocols to use Olympus’ bonding scheme for their own liquidity needs. The projects like StakeDAO, Alchemix, Thorstarter, and Bankless are turning to Olympus-style bonds.

As recently reported, The defi project OlympusDAO rolled out its $3.3 million bug bounty program that will underpin the cryptocurrency called OHM. OHM is marketed as a free-floating reserve currency which means it is backed by a basket of different assets rather than a fiat currency. This “free-floating” feature means that the OHM token is subject to extreme bouts of volatility that are seen in traditional cryptocurrencies like BTC or ETH despite some doubts as the project gained traction since its inception of 2021. Backed by meme culture, OlympusDAO stands out among other DEFI projects thanks to its tokenomics that aims to control the supply expansion in a variety of solutions.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post