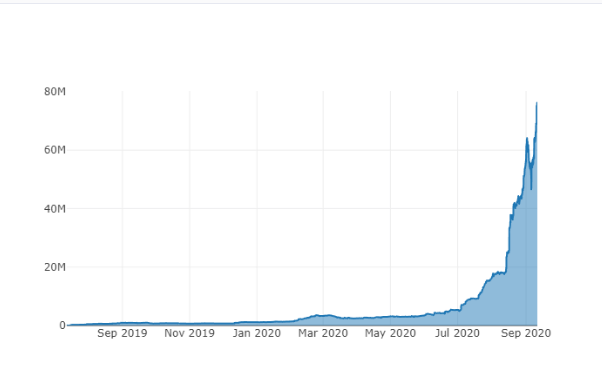

Nexus Mutual, the insurance coverage provider for Defi protocols, just surpassed $74 million in active coverage. It is now covering 206,763 ETH which is about 1% of the total DeFi market as the partner at 1Confirmation Richard Chen said for our latest cryptocurrency news:

“Nexus Mutual just crossed 1% of TVL in DeFi covered! Great achievement but still long ways to go.”

.@NexusMutual just crossed 1% of TVL in DeFi covered! Great achievement but still long ways to go. 🚀

Source: https://t.co/ak79wv8Czz pic.twitter.com/xMDX7P7PMQ

— Richard Chen (@richardchen39) September 10, 2020

Its TVL still remains low compared to other DeFi protocols but it is still one of the two major insurance underwriters. DeFi insurance is a nascent market and the question whether it will succeed is still uncertain. The industry executives are optimistic about NXM and the DeFi insurance as a whole but according to Yan Liberman, the co-founder of Delphi Digital, the main market of DeFi insurance is still untapped. There’s also room for growth in the DeFi sector especially for the key players such as Yearn Finance’s Yinsure and Nexus Mutual as Liberman noted:

“Projects will often use their supply-side to incentivize an environment where demand side can grow. Nexus is dealing with the opposite. It has immediate product-market fit, evidenced by the growth in coverage and how quickly excess capacity for cover is usually purchased. Even with all the recent growth in cover, the target market is still largely unaddressed.”

One of the skepticism about the trajectory of Nexus Mutual is the Know your Customer enabled platform. In order to purchase NXM the users will have to undergo KYC. Because of KYC, major exchanges such as Binance listed Wrapped NXM which doesn’t require KYC to hold.

buy bactroban online gilbertroaddental.com/wp-content/themes/twentyseventeen/inc/en/bactroban.html no prescription

Liberman stated that NXM has the doors wide open for the integration with Yearn.finance as it recently selected NXM as an insurance underwriter. In the few months after the launch, Yearn.Finance evolved as a DeFi giant with the valuation reaching $1 billion after the Coinbase listing. Based on the accessibility of NXM and the coverage of Yearn.finance, Liberman noted that NXM has huge potential:

“On the demand side, product market fit is and always will be a primary driver, but accessibility is also important. That’s why the recent integration with Yearn will be huge. $YFI enables users to purchase NXM underwritten insurance without KYC.”

After the listings of yearn.finance’s native token by Binance and Coinbase, the awareness of DeFi started to increase. The Defi sector is mainly used by native crypto users and it remains untouched by casual users. in the long run when ETH 2.0 launches, the DeFi market has plenty of room to grow.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post