The new macro factors and institutional interest that are weighing in, are making the crypto market rise again following last week’s selloff so let’s read more in our altcoin news today.

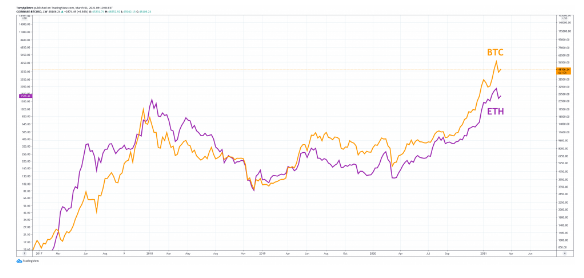

Bitcoin and the rest of the crypto market rallied alongside the US equity markets and BTC retraced below $49K with ETH recovering to $1500. The biggest crypto names also recovered except for Cardano which saw a slight drop to $1.24. In the equity markets, the Dow soared 603 points and NASDAQ 496 points as the treasury yields cooled and the Congress revealed that the new stimulus package is on its way.

The stimulus package could turn out to be a strong boost for the BTC rally and the $1400 payment for all Americans will find a way to the crypto markets as it seems. Historically, this has been the case so when the past two stimulus checks are passed by the regulators, the exchanges surge in usage. A year ago, we saw deposits equal to stimulus check payouts that appeared across crypto exchanges and one analyst from Bank of America stated that a dramatic increase in retail activity is imminent with another wave of stimulus money.

With the renewed public interest in BTC and altcoins, the stimulus injection will serve as another catalyst for the continued bullish trend into the second quarter of 2021. Goldman Sachs Group restated its crypto trading desk, which is another macro factor that is weighing in on the market. with more institutions taking advantage of BTC, Goldman will reboot its operations from 2018. They will offer derivatives based on the BTC futures and will explore a new crypto exchange-traded fund.

The new opportunities in the crypto and blockchain space are arising with the likes of the Central Bank exploring a potential Central Bank Digital currency by reestablishing crypto-based offerings and new infrastructure. Goldman Sachs is one of the first major banks to offer crypto-related products to clients and there will be more to follow.

As reported recently, Bitcoin escapes dollar rebound but if history repeats and the dollar surges, a short-term bearish phase will be coming to the market. 2021 has been the best year for bitcoin so far while 2020 was the worst for both the dollar and the cryptocurrency as the sentiment turned negative and the inflation fears pushed investors towards assets like gold and crypto.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post