The markets are calming down as BTC ends its worst week in a year and the investor confidence returns to the markets as well with the upcoming $1.9 trillion recovery plan from the new Biden administration causing concerns but let’s read more in our latest altcoin news today.

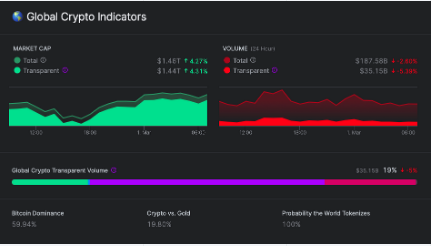

The markets are calming down with a few signs of recovery after the huge losses of the week. The investors began opening their crypto wallets with a sigh of relief as a relative calm seems to be returning to the markets. The global market cap is recovering after this week’s bloodbath and it increased by 4% in the past 24hours to $1.4 trillion. During the market route, it crashed to $1.3 trillion while Bitcoin seems to be on the road to recovery as well after dropping as low as $43K over the past week.

The largest cryptocurrency dropped by 25% which was its worst performance since the market collapse and the volatility shot above 5% for the 30 and 60-day rolling averages. By comparison, Bitcoin’s price swings dropped to 1.7% and made BTC a more stable store of value than some of the biggest fiat currencies in the world. with the boom in price, however, came a boom in uncertainty. It was a similar sight for the broader crypto markets with almost all of the top 20 showing gains. ETH recovered strongly in the past day and gained about 6% helped along with Aave’s 18% jump bringing the native token back in the world’s 20 biggest.

Cardano clung to the top three slots despite the market recovery while Binance dropped two places to the fifth spot after its native token lost a third of its value as it reached an all-time high of $333 a few days ago. The markets seem to be in the green due to investors’ confidence and the US and EU markets are all rising over the weekend on the news that the world will continue bond purchases to prevent market jitters from stifling the recovery. The worry was that as the yields from government bonds gathered pace, the inflation was sneaking back into the economy which means that central banks could have to rein in the lavish bond-buying programs that have kept the markets afloat, as Etsy Dwek said:

“With a lot of the move in yields due to the improving growth outlook and reopening prospects, risk appetite is holding up. The pace and scale of the move in yields is more important than the absolute level, suggesting that as long as the move is gradual, risk assets should be able to absorb them.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post