The market leaders struggle as BTC slides below $40K and the potential regulatory approvals and adoptions slowed down as well so let’s read more today in our latest altcoin news.

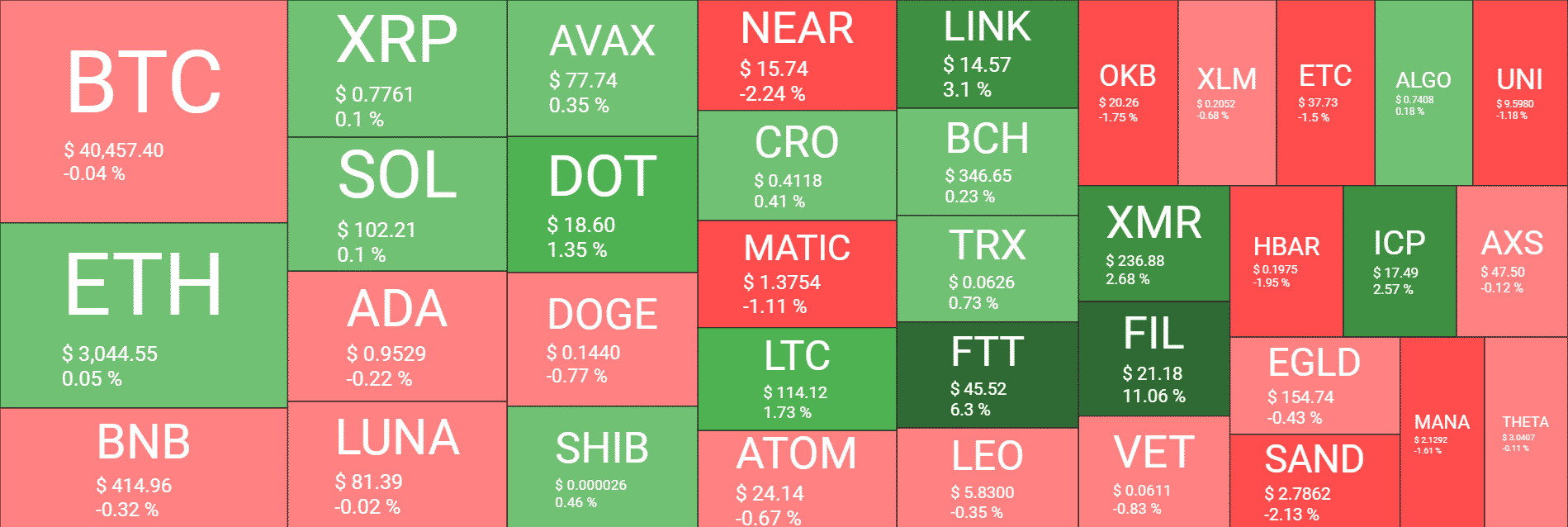

Most leading cryptocurrencies dropped over the past week but the losses were not as severe as the previous week. Bitcoin dropped 5% over the past week and at the time of writing, it was trading at $40,205 while rival ETH dipped 5.8% over the past week and traded for $3,040. the market leaders struggle with weekly losses of up to 8% like Solana for example which is trading for $102 and ADA for $0.9536. Terra’s LUNA posted the biggest losses among the top 30 coins for the week and dropped 15% to $81.31. Both Cosmos and ETC also dipped a little over 10% this week and traded for $23.32 and $39.99 respectively. The world’s biggest exchange Binance also gained an in-principle approval from the financial regulators in Abu Dhabi which gives binance the green light to apply for a licnese in the UAE and operate as a virtual asset broker-dealer. If the application succeeds, the exchange can service customers across the MENA region via a subsidiary.

The crypto payments company Circle announced a $400 million funding round led by the asset manager BlackRock which is the world’s biggest with over $10 trillion in assets under management and tapped to take the lead on the fiat reserves backing Circle’s USDC stabelcoin. Binance’s CEO Changpeng Zhao announced that the company will get floorspace in the Studio F startup in Paris and the move came as a part of Binance’s $100 million investment drive in France.

The deal means that Binance’s selected crypto startups will get free accommodation and will gain access to various resources at the Stadion F during the incubation period as well as access to support the Binance Team and partners. Furthermore, CoinSwitch Kuber became the second major Indian crypto that will disable cash deposits via the popular United Payments Interface payments system and the central bank regulated UPI system allowed Indian users to deposit cash and buy crypto on the platform.

CoinSwitch also cited regulatory uncertainty as the main reason for suspending UPI deposits and former RIpple adviser and law professor Michael Barr got to be Biden’s choice for the vice-chair for supervision at the Federal Reserve. Biden took a moderate stance on crypto as he seeks to integrate and regulate it into America’s financial system and at the same time, the Portuguese regulators licensed Bison Bank to act as the crypto bank in the country which is authoirzed to launch digital assets and conduct custodial and exchange services of crypto.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post