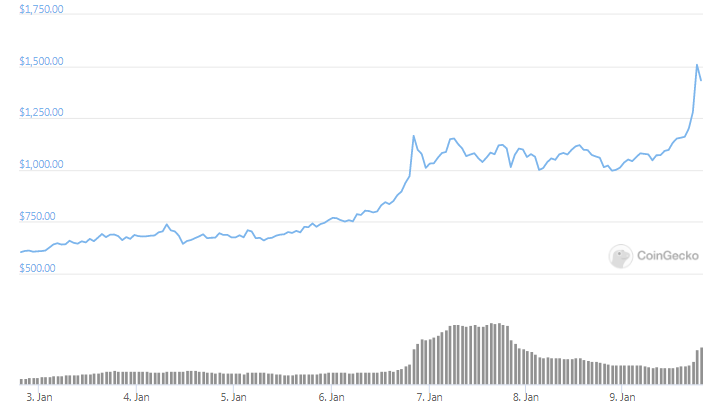

Maker’s MKR ripper higher by 80% over the past week despite the drops recorded in the previous month against Ethereum. In our latest altcoin news, we are taking a closer look at the price analysis.

Back in March, MKR traded at 2.5 ETH which means that it cost 2.5 ETH to buy one of the tokens. however, since then, the cryptocurrency was on a decline against the second biggest asset and fell from the 2.5 level to 0.7 ETH recently. This came in spite of the strong growth of the market capitalization of DAI which is the native stable coin of MakerDAO and the crypto through which the loans on the platform are issued.

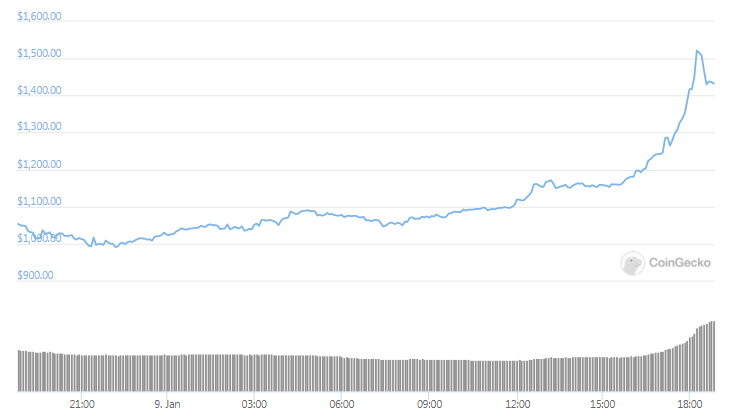

Maker’s MKR ripped higher by 80% in the past seven days nonetheless which means it reached a multi-year high against the US dollar. The price traded as high as 1.05 ETH per coin or 00 which is the highest level recorded in months.

buy lasix online https://nosesinus.com/wp-content/themes/twentytwentytwo/inc/patterns/new/lasix.html no prescription

The rally of the coin comes as the MAkerDAO platform that allows users to deposit crypto collateral and to take loans in DAI, continued to maintain the dominance as the most-used Defi protocol by total value locked. There are $4.21 billion worth of crypto that is locked on the platform right now.

Users can deposit collateral and pay a fee on that collateral depending on what coin it is and then take out DAI as a loan. These fees accrue to MKR holders via the token burns and more than 2.25 percent of all MKR in circulation will be burnt in the next year if the current fee structure is maintained. The rise in the price of the coin continued higher while the need for decentralization of stablecoin grows. While centralized stablecoins were validated by the US Treasury in multiple announcements about the banks’ ability to use the technology, there are some that fall under banking laws.

MakerDao still the TVL King and seriously pulling away from everyone else…..and as demand for leverage rises with risk appetite in 2021, its leadership will extend further.

I predicted in Dec 2019 that $MKR will hit $1000 by end 2020. It got to my target 6 days late….. pic.twitter.com/VprVcjq6iQ

— SpartanBlack (@SpartanBlack_1) January 6, 2021

The House Democrats unveiled a bill that puts stablecoins under banking law but DAI and other decentralized stablecoins could still fall in this category so it means it will be hard to regulate these coins centralized since there’s no central issuer.

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post