Maker surged 7% right after the scalability fees were introduced, while the DeFi space saw a huge surge in 2020 so let’s go on and find out more about the latest price analysis of Maker in our altcoin news.

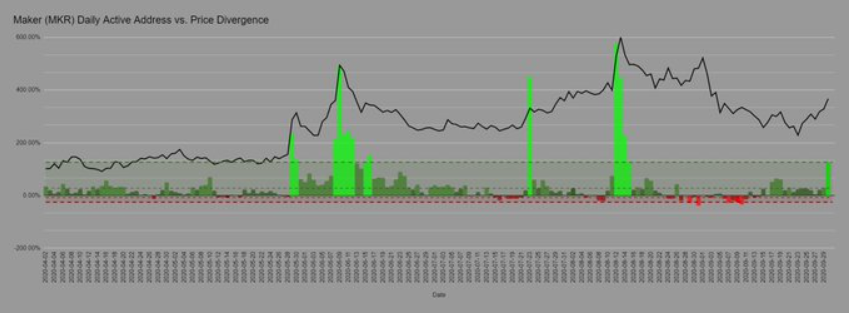

The decentralized finance space has seen huge growth over this year but Maker which was strongly tied to Defi, underperformed. The cryptocurrency relative to the competitors is underperforming unlike Aave’s LEND and the SNX token which surged hundreds of percent this year alone. MKR only saw a 20% move higher. The market could be changing its mind however as Maker surged by 7% over the past day and seems to be poised for more growth as the fundamentals of the underlying MAkerDAO protocol aligned in favor of the growth. Santiment, the blockchain analytics firm reported that the cryptocurrency has the biggest bullish divergence between the daily active addresses and the current price among 100 blockchains that they track. This only suggests that MKR is increasing the user count which is not reflected in the price action yet:

“On top of this, from a pure network activity perspective, $MKR currently has the largest bullish divergence between daily active addresses and current price (based on historical means) of any top 100 #blockchain we track.”

Chris Burniske, the partner at Placeholder Capital echoed his optimism about Maker and he recently noted that most of the investors in the crypto space are now sleeping on MKR despite the utility of the protocol that is going through the roof as more research is being done about how the coin captures the value:

“People mostly sleeping on $MKR while utility goes through the roof, and conversations abound around its value capture model.”

Adding to this, the stability fees were reimplemented into the MakerDAO protocol after a long period of 0% rates. This means that the MKR coin could start to accrue value once again as the protocol starts generating fees which will result in the buying back and burning of the MKR Tokens. Corroborating the MKR bulls case, the analysts see reasons to be long-term bullish on the DeFi space and now with Maker representing a core asset of DeFi, it will benefit the rest of the space if it gains more traction. Commenting on the Defi space as a whole, Spencer Noon wrote:

“The strong fundamental backdrop to #crypto — which is unlike any bull market previously — is that there are billions of cryptodollars coming on-chain to use #DeFi. Unless that shows signs of slowing, we are on track for a multi-trillion dollar aggregate marketcap for the space.”

FYI @MakerDAO will let you take a loan regardless of your race, gender, ethnicity, or if you are a cat on the internet.

Long open access technology.

— Julian 🤹 (@juliankoh) September 29, 2020

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post