The Maker DEFI token surged 30% as the users flocked to DAI after the recent collapse of Terra as we reported earlier in the cryptocurrency news.

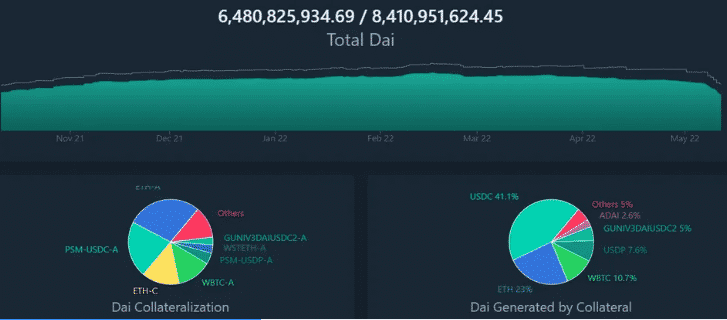

While the crypto markets staged a rebound on Friday morning, the MakerDAO governance token MKR surged by 30% as investors bet on the DAI Stablecoin amid the Terra collapse. MKR was the eighth biggest DEFI token with a market cap of $1.4 billion while in the meantime, DAI became the fourth biggest stablecoin with a market cap of $6.47 billion. The surge in interest was enough to make the coin the second biggest DEFI token that accounted for 7% of the $146 billion total value locked in DEFI protocols and surpassed Curve, SushiSwap, and Lido. Over the past day, the market cap for DAI increased by 2% and increased from $6.34 billion but the increase indicates that users turned to Maker and mint more DAI.

The Maker DEFI token surged as there has been quite the interest in the DAI stablecoin while Terra continues crashing. The Terra validators halted the blockchain for two hours and resumed validating the transactions but then halted it again a few hours later. Since then, LUNA went up to $0.0000353 which is down by 99.9% from yesterday and the TerraUSD algorithmic stablecoin dropped to $0.19 down by 69% over the past day. As the token and the stablecoin crashed, Binance made good on the plans to halt the trading and delist them.

Maker is a DeFi lending and borrowing protocol so the user slock up their crypto BTC or ETH for example as collateral in the Maker Vault and mint DAI against it so the assets stay locked in the vault until their repaired their DAI. DAI is an algorithmic stablecoin like UST but unlike UST it is overcolltaralized which means when the users lock up their crypto and borrow against it but they are allowed to borrow DAI worth 55% to 75% of the collateral but the model is much safer. The former head of backend services at Maker said:

“Partially collateralized stablecoins have repeatedly failed over and over. They cannot solve the fundamental problem of bank runs when the peg is under pressure.”

MakerDAO explained how the vault works and why the bearish markets trigger forced liquidations of the collateral to maintain these ratios:

“The Maker Protocol is healthy, liquid, and solvent with a 164% collateralization ratio and billions in liquidity reserves. All DAI is overcollateralized, and its peg is as strong as this Decentralized Protocol.”

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at editor@dcforecasts.com

Discussion about this post