The Lydia French fintech attained its Unicorn status after the latest $100 million series C funding acquired by Dragoneers and Echo Street investors along with existing backers Accel, Tencent, and Founders future as we are reading more in today’s cryptocurrency news.

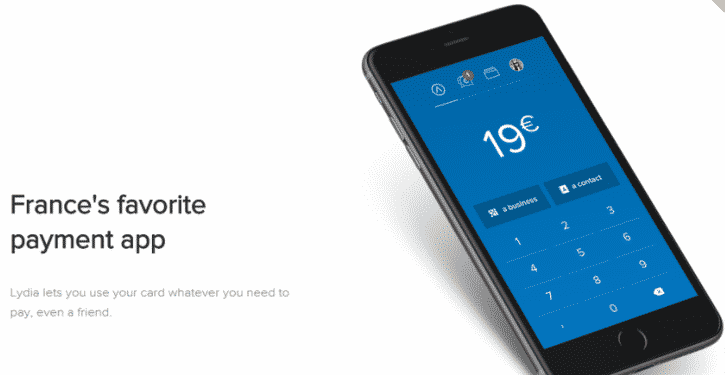

The Lydia French Fintech raised $100 million in Series C funding which brought it its unicorn status with a valuation of over $1 billion. The funding round included new investors Echo Street and Dragoneers alongside Accel, Founders Futures, Tencent, and TechCrunch. Lydia allowed its 5.5 million users to invest in digital assets including fractional stocks and crypto in partnership with Austrian exchange Bitpanda.

The company raised $131 million in two funding rounds last year and offers a huge range of services including current accounts, mobile payments, and investments via its app and express loans. Lydia plans to use the funds to hire more staff over the next three years and expand its customer base to 10 million in three years.

As recently reported, A major French state-owned bank is now joining Bitcoin’s (BTC) Lightning Network which secured $8 million in funding from partners. Bitcoin technology company ACINQ confirmed the news – bringing the total investment to $10 million. The funding initially came from the lead contributor named Idinvest Partners, which is known for its focus on small and medium-sized European businesses. Among the involved parties were also the names of Bpifrance, an investment bank created by two French public entities. For now, the French state-owned bank is leading the way.

All of this led to the government is very close to directly funding the improvement of Bitcoin in what is seen as a softening of the country’s stance on cryptocurrency. ACINQ stated that it would use the money to improve the Lighting protocol as well as expand its own business operations. The update comes right as commentators continue to put faith in the fact that Lighting allows for faster and cheaper Bitcoin transactions.

The French central bank continues to explore central bank digital currencies after completing a trial of blockchain-based CBDC in the country’s debt market. More than 500 institutions in France participated in the 10-month experiment testing a CBDC issued by the Banque de France for bond deals with the government, the reports showed. The CBDC trial was led by Belgium-based financial services company Euroclear by using a system developed by the American technology giant IBM. The CBDC test involves a French public debt office alongside the central bank and the consortium of major financial companies that are operating in France like companies such as BNP Paribas, HSBC, Societe Generale, Credit Agricole CIB, and more.

buy cialis black online www.ecladent.co.uk/wp-content/themes/twentyseventeen/inc/en/cialis-black.html no prescription

DC Forecasts is a leader in many crypto news categories, striving for the highest journalistic standards and abiding by a strict set of editorial policies. If you are interested to offer your expertise or contribute to our news website, feel free to contact us at [email protected]

Discussion about this post